Next earnings date: 22 Sep 2025

AutoZone, Inc. – NYSE:AZO

AutoZone stock price today

AutoZone stock price monthly change

AutoZone stock price quarterly change

AutoZone stock price yearly change

AutoZone key metrics

Market Cap | 54.23B |

Enterprise value | 57.74B |

P/E | 20.81 |

EV/Sales | 3.41 |

EV/EBITDA | 15.38 |

Price/Sales | 2.83 |

Price/Book | -11.44 |

PEG ratio | 0.87 |

EPS | 150.51 |

Revenue | 17.87B |

EBITDA | 3.97B |

Income | 2.67B |

Revenue Q/Q | N/A |

Revenue Y/Y | N/A |

Profit margin | 14.32% |

Oper. margin | 19.43% |

Gross margin | 51.43% |

EBIT margin | 19.43% |

EBITDA margin | 22.26% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeAutoZone stock price history

AutoZone stock forecast

AutoZone financial statements

$3,393.76

Potential downside: -18.34%

Analysts Price target

Financials & Ratios estimates

| May 2023 | 4.09B | 647.72M | 15.83% |

|---|---|---|---|

| Aug 2023 | 5.69B | 864.84M | 15.2% |

| Feb 2024 | 3.85B | 515.03M | 13.35% |

| May 2024 | 4.23B | 651.72M | 15.39% |

| 2024-09-17 | 53.81 | 36.69 |

|---|---|---|

| 2024-09-24 | 53.53 | 51.58 |

| May 2023 | 15597922000 | 19.89B | 127.58% |

|---|---|---|---|

| Aug 2023 | 15985878000 | 20.33B | 127.21% |

| Feb 2024 | 16717654000 | 21.55B | 128.94% |

| May 2024 | 17108432000 | 21.94B | 128.28% |

| May 2023 | 724.71M | -208.96M | -543.58M |

|---|---|---|---|

| Aug 2023 | 1.06B | -397.20M | -671.77M |

| Feb 2024 | 434.12M | -273.48M | -140.61M |

| May 2024 | 669.48M | -372.26M | -326.12M |

AutoZone alternative data

| Aug 2023 | 78 |

|---|---|

| Sep 2023 | 73 |

| Oct 2023 | 76 |

| Nov 2023 | 94 |

| Dec 2023 | 81 |

| Jan 2024 | 68 |

| Feb 2024 | 66 |

| Mar 2024 | 68 |

| Apr 2024 | 100 |

| May 2024 | 90 |

| Jun 2024 | 86 |

| Jul 2024 | 104 |

| Aug 2024 | 88 |

| Sep 2024 | 101 |

| Oct 2024 | 108 |

| Nov 2024 | 171 |

| Dec 2024 | 108 |

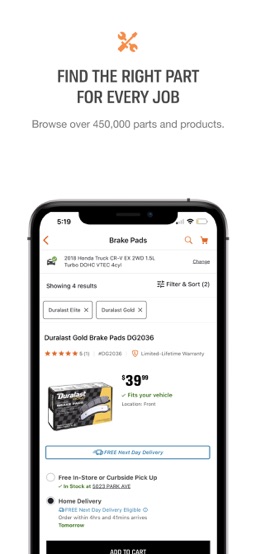

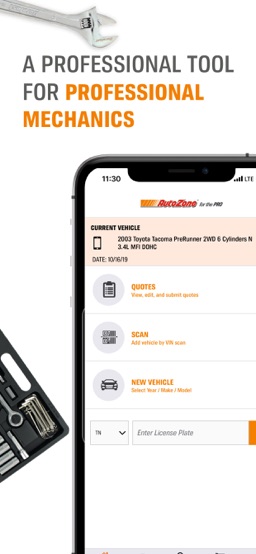

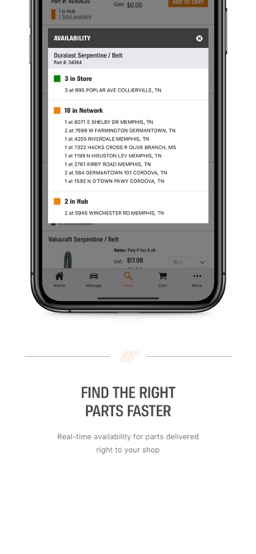

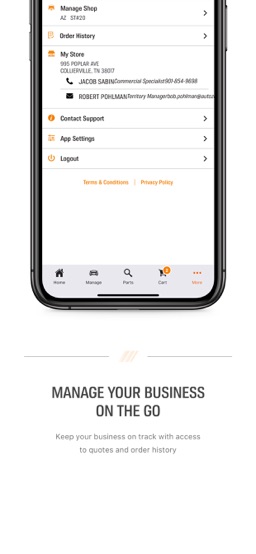

AutoZonePro Mobile

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 96 |

|---|---|

| Sep 2023 | 97 |

| Oct 2023 | 118 |

| Nov 2023 | 107 |

| Dec 2023 | 94 |

| Jan 2024 | 123 |

| Feb 2024 | 110 |

| Mar 2024 | 102 |

| Apr 2024 | 151 |

| May 2024 | 110 |

| Jun 2024 | 127 |

| Jul 2024 | 129 |

| Aug 2024 | 104 |

| Sep 2024 | 100 |

| Oct 2024 | 103 |

| Nov 2024 | 130 |

| Dec 2024 | 136 |

| Dec 2023 | 371 |

|---|---|

| Feb 2024 | 500 |

| Mar 2024 | 372 |

| Apr 2024 | 487 |

| Jun 2024 | 420 |

| Sep 2024 | 473 |

| Nov 2024 | 452 |

| Aug 2023 | 4 |

|---|---|

| Sep 2023 | 6 |

| Oct 2023 | 6 |

| Nov 2023 | 6 |

| Dec 2023 | 6 |

| Jan 2024 | 6 |

| Feb 2024 | 7 |

| Mar 2024 | 6 |

| Apr 2024 | 7 |

| May 2024 | 6 |

| Jun 2024 | 6 |

| Jul 2024 | 6 |

| Aug 2024 | 8 |

| Sep 2024 | 9 |

| Oct 2024 | 9 |

| Nov 2024 | 11 |

| Dec 2024 | 10 |

AutoZone Social Media Accounts

| Sep 2023 | 3184417 |

|---|---|

| Oct 2023 | 3189579 |

| May 2025 | 104741 |

|---|---|

| Jul 2025 | 107372 |

| Aug 2025 | 108875 |

Auto Parts

| 19 Feb 2023 | 22 | 67 | 23 |

|---|---|---|---|

| 26 Feb 2023 | 24 | 70 | 22 |

| 5 Mar 2023 | 23 | 72 | 22 |

| 12 Mar 2023 | 23 | 68 | 21 |

| 19 Mar 2023 | 23 | 65 | 22 |

| 26 Mar 2023 | 22 | 65 | 23 |

| 2 Apr 2023 | 22 | 66 | 22 |

| 9 Apr 2023 | 22 | 65 | 22 |

| 16 Apr 2023 | 22 | 65 | 22 |

| 23 Apr 2023 | 22 | 65 | 23 |

| 30 Apr 2023 | 21 | 59 | 21 |

| 7 May 2023 | 23 | 60 | 22 |

| 14 May 2023 | 22 | 61 | 23 |

| 21 May 2023 | 23 | 62 | 22 |

| 28 May 2023 | 23 | 60 | 23 |

| 4 Jun 2023 | 28 | 60 | 24 |

| 11 Jun 2023 | 26 | 58 | 23 |

| 18 Jun 2023 | 21 | 55 | 22 |

| 25 Jun 2023 | 25 | 64 | 26 |

| 2 Jul 2023 | 24 | 59 | 25 |

AutoZone

| 30 Mar 2025 | 92 |

|---|---|

| 6 Apr 2025 | 95 |

| 13 Apr 2025 | 91 |

| 20 Apr 2025 | 91 |

| 27 Apr 2025 | 86 |

| 4 May 2025 | 89 |

| 11 May 2025 | 84 |

| 18 May 2025 | 84 |

| 25 May 2025 | 84 |

| 1 Jun 2025 | 81 |

| 8 Jun 2025 | 76 |

| 15 Jun 2025 | 82 |

| 22 Jun 2025 | 81 |

| 29 Jun 2025 | 84 |

| 6 Jul 2025 | 81 |

| 13 Jul 2025 | 82 |

| 20 Jul 2025 | 75 |

| 27 Jul 2025 | 86 |

| 3 Aug 2025 | 95 |

| 10 Aug 2025 | 84 |

Competitors

| 11 Jun 2023 | 78 | 30 | 1 | 8 |

|---|---|---|---|---|

| 18 Jun 2023 | 82 | 38 | 1 | 9 |

| 25 Jun 2023 | 83 | 36 | 1 | 9 |

| 2 Jul 2023 | 81 | 35 | 1 | 8 |

| 9 Jul 2023 | 74 | 34 | 1 | 7 |

| 16 Jul 2023 | 79 | 34 | 1 | 8 |

| 23 Jul 2023 | 81 | 35 | 1 | 8 |

| 30 Jul 2023 | 77 | 32 | 1 | 7 |

| 6 Aug 2023 | 78 | 33 | 1 | 7 |

| 13 Aug 2023 | 74 | 32 | 1 | 7 |

| 20 Aug 2023 | 70 | 30 | 1 | 6 |

| 27 Aug 2023 | 75 | 32 | 1 | 7 |

| 3 Sep 2023 | 70 | 34 | 1 | 7 |

| 10 Sep 2023 | 74 | 31 | 1 | 8 |

| 17 Sep 2023 | 73 | 31 | 1 | 7 |

| 24 Sep 2023 | 75 | 30 | 1 | 6 |

| 1 Oct 2023 | 71 | 29 | 1 | 7 |

| 8 Oct 2023 | 66 | 26 | 1 | 6 |

| 15 Oct 2023 | 81 | 35 | 1 | 8 |

| 22 Oct 2023 | 72 | 29 | 1 | 7 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 49,807 |

|---|---|

| Oct 2023 | 57,200 |

| Nov 2023 | 56,610 |

| Dec 2023 | 56,842 |

| Jan 2024 | 57,348 |

| Feb 2024 | 57,910 |

| Apr 2024 | 41,605 |

| May 2024 | 66,688 |

| Jun 2024 | 66,372 |

| Jul 2024 | 42,177 |

| Dec 2024 | 38,722 |

| Sep 2023 | 69,440 |

|---|---|

| Oct 2023 | 69,440 |

| Nov 2023 | 71,400 |

| Dec 2023 | 71,400 |

| Jan 2024 | 71,400 |

| Feb 2024 | 71,400 |

| Mar 2024 | 71,400 |

| Apr 2024 | 71,400 |

| May 2024 | 71,400 |

| Jun 2024 | 71,400 |

| Jul 2024 | 71,400 |

AutoZone other data

| Period | Buy | Sel |

|---|---|---|

| Jan 2024 | 0 | 13112 |

| Feb 2024 | 0 | 3000 |

| Mar 2024 | 0 | 30125 |

| May 2024 | 36 | 0 |

| Sep 2024 | 0 | 880 |

| Oct 2024 | 0 | 26500 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | RHODES WILLIAM C III director, officer.. | Common Stock | 13,000 | $772.8 | $10,046,400 | ||

Option | RHODES WILLIAM C III director, officer.. | Common Stock | 13,000 | $772.8 | $10,046,400 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 41 | $3,089.46 | $126,668 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 41 | $3,089.46 | $126,668 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,140.59 | $314,059 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,140.59 | $314,059 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,139.55 | $313,955 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,139.55 | $313,955 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,127.87 | $312,787 | ||

Sale | RHODES WILLIAM C III director, officer.. | Common Stock | 100 | $3,127.87 | $312,787 |

| Quarter | Transcript |

|---|---|

| Q3 2024 21 May 2024 | Q3 2024 Earnings Call Transcript |

| Q2 2024 27 Feb 2024 | Q2 2024 Earnings Call Transcript |

| Q1 2024 5 Dec 2023 | Q1 2024 Earnings Call Transcript |

| Q4 2023 19 Sep 2023 | Q4 2023 Earnings Call Transcript |

Trump's New Tariffs: Top U.S.-Centric Stocks Amid Escalating Trade Tensions

AutoZone: Potential Sales Re-Acceleration Bolsters Bullish Case

BP: A Cannibal Stock In The Making?

AutoZone Is A Buy Breaking Out To New Highs (Technical Analysis)

AutoZone: Long-Term Play With Shareholder Focus And A Growth Plan

AutoZone: Solid Parts, But Valuation Needs A Tune-Up

AutoZone: An Intriguing Growth Stock For The Watch List

4 American Retailers You Should Consider Buying

O'Reilly Automotive: The Winning Combination Of Buybacks And Market Share Growth

-

What's the price of AutoZone stock today?

One share of AutoZone stock can currently be purchased for approximately $4,156.

-

When is AutoZone's next earnings date?

AutoZone, Inc. is estimated to report earnings on Monday, 22 Sep 2025.

-

Does AutoZone pay dividends?

No, AutoZone does not pay dividends.

-

How much money does AutoZone make?

AutoZone has a market capitalization of 54.23B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 5.92% to 18.49B US dollars. AutoZone earned 2.66B US dollars in net income (profit) last year or $51.58 on an earnings per share basis.

-

What is AutoZone's stock symbol?

AutoZone, Inc. is traded on the NYSE under the ticker symbol "AZO".

-

What is AutoZone's primary industry?

Company operates in the Consumer Cyclical sector and Specialty Retail industry.

-

How do i buy shares of AutoZone?

Shares of AutoZone can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are AutoZone's key executives?

AutoZone's management team includes the following people:

- Mr. William C. Rhodes III Chairman, Pres & Chief Executive Officer(age: 60, pay: $5,250,000)

- Mr. Jamere Jackson Chief Financial Officer, Executive Vice President - Fin. & Store Devel. and Customer Satisfaction(age: 56, pay: $3,410,000)

- Mr. Thomas B. Newbern Executive Vice President of International, Information Technology & ALLDATA(age: 63, pay: $2,220,000)

- Mr. Mark A. Finestone Executive Vice President of Strategy & Innovation(age: 64, pay: $1,990,000)

- Ms. Seong K. Ohm Senior Vice President of Merchandising & Customer Satisfaction(age: 61, pay: $1,290,000)

-

How many employees does AutoZone have?

As Jul 2024, AutoZone employs 71,400 workers.

-

When AutoZone went public?

AutoZone, Inc. is publicly traded company for more then 34 years since IPO on 2 Apr 1991.

-

What is AutoZone's official website?

The official website for AutoZone is autozone.com.

-

Where are AutoZone's headquarters?

AutoZone is headquartered at 123 South Front Street, Memphis, TN.

-

How can i contact AutoZone?

AutoZone's mailing address is 123 South Front Street, Memphis, TN and company can be reached via phone at +90 14956500.

-

What is AutoZone stock forecast & price target?

Based on 14 Wall Street analysts` predicted price targets for AutoZone in the last 12 months, the avarage price target is $3,393.76. The average price target represents a -18.34% change from the last price of $4,156.

AutoZone company profile:

AutoZone, Inc.

autozone.comNYSE

75,600

Specialty Retail

Consumer Cyclical

AutoZone, Inc. retails and distributes automotive replacement parts and accessories. The company offers various products for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. Its products include A/C compressors, batteries and accessories, bearings, belts and hoses, calipers, chassis, clutches, CV axles, engines, fuel pumps, fuses, ignition and lighting products, mufflers, radiators, starters and alternators, thermostats, and water pumps, as well as tire repairs. In addition, the company offers maintenance products, such as antifreeze and windshield washer fluids; brake drums, rotors, shoes, and pads; brake and power steering fluids, and oil and fuel additives; oil and transmission fluids; oil, cabin, air, fuel, and transmission filters; oxygen sensors; paints and accessories; refrigerants and accessories; shock absorbers and struts; spark plugs and wires; and windshield wipers. Further, it provides air fresheners, cell phone accessories, drinks and snacks, floor mats and seat covers, interior and exterior accessories, mirrors, performance products, protectants and cleaners, sealants and adhesives, steering wheel covers, stereos and radios, tools, and wash and wax products, as well as towing services. Additionally, the company provides a sales program that offers commercial credit and delivery of parts and other products; sells automotive diagnostic and repair software under the ALLDATA brand through alldata.com and alldatadiy.com; and automotive hard parts, maintenance items, accessories, and non-automotive products through autozone.com. As of November 20, 2021, it operated 6,066 stores in the United States; 666 stores in Mexico; and 53 stores in Brazil. The company was founded in 1979 and is based in Memphis, Tennessee.

Memphis, TN 38103

CIK: 0000866787

ISIN: US0533321024

CUSIP: 053332102