Next earnings date: 16 Oct 2025

KeyCorp – NYSE:KEY

KeyCorp stock price today

KeyCorp stock price monthly change

KeyCorp stock price quarterly change

KeyCorp stock price yearly change

KeyCorp key metrics

Market Cap | 16.95B |

Enterprise value | 33.81B |

P/E | 110.28 |

EV/Sales | 3.89 |

EV/EBITDA | 59.52 |

Price/Sales | 1.96 |

Price/Book | 0.96 |

PEG ratio | 7.32 |

EPS | 0.79 |

Revenue | 8.40B |

EBITDA | 1.77B |

Income | 874M |

Revenue Q/Q | 61.19% |

Revenue Y/Y | 19.08% |

Profit margin | 1.71% |

Oper. margin | 31.12% |

Gross margin | 100.29% |

EBIT margin | 31.12% |

EBITDA margin | 21.09% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeKeyCorp stock price history

KeyCorp stock forecast

KeyCorp financial statements

$18.6

Potential upside: 2.53%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 1.54B | 287M | 18.56% |

|---|---|---|---|

| Sep 2023 | 1.52B | 303M | 19.93% |

| Dec 2023 | 2.66B | 65M | 2.44% |

| Mar 2024 | 2.67B | 219M | 8.17% |

| 2024-10-17 | 0.2797 | 0.3 |

|---|

Paying a dividend greater than earnings.

| Payout ratio | 619.59% |

|---|

| 2019 | 4% |

|---|---|

| 2020 | 5.22% |

| 2021 | 3.76% |

| 2022 | 5.3% |

| 2023 | 6.82% |

| Jun 2023 | 195037000000 | 29.02B | 14.88% |

|---|---|---|---|

| Sep 2023 | 187851000000 | 24.77B | 13.19% |

| Dec 2023 | 188281000000 | 173.64B | 92.23% |

| Mar 2024 | 187485000000 | 172.93B | 92.24% |

| Jun 2023 | 582M | 1.92B | -2.52B |

|---|---|---|---|

| Sep 2023 | 566M | 6.24B | -6.79B |

| Dec 2023 | 1.03B | 592M | -1.45B |

| Mar 2024 | 359M | 374M | -427M |

KeyCorp alternative data

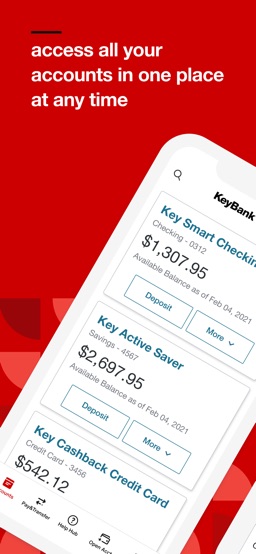

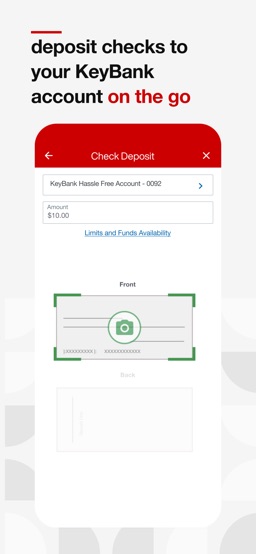

KeyBank Mobile Banking

| Platform: | iOS |

| Store: | App Store |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 241 |

|---|---|

| Sep 2023 | 218 |

| Oct 2023 | 244 |

| Nov 2023 | 249 |

| Dec 2023 | 267 |

| Jan 2024 | 258 |

| Feb 2024 | 267 |

| Mar 2024 | 291 |

| Apr 2024 | 277 |

| May 2024 | 292 |

| Jun 2024 | 267 |

| Jul 2024 | 248 |

| Aug 2024 | 233 |

| Sep 2024 | 311 |

| Oct 2024 | 268 |

| Nov 2024 | 233 |

| Dec 2024 | 277 |

KeyCorp Social Media Accounts

| Aug 2023 | 132686 |

|---|---|

| Sep 2023 | 132888 |

| Oct 2023 | 133177 |

| May 2025 | 14071 |

|---|---|

| Jul 2025 | 15149 |

| Aug 2025 | 15548 |

KeyCorp Products

| 19 Feb 2023 | 2 | 9 | 1 | 0 | 0 |

|---|---|---|---|---|---|

| 26 Feb 2023 | 2 | 10 | 1 | 0 | 0 |

| 5 Mar 2023 | 1 | 9 | 1 | 0 | 0 |

| 12 Mar 2023 | 1 | 9 | 1 | 0 | 0 |

| 19 Mar 2023 | 1 | 8 | 1 | 0 | 0 |

| 26 Mar 2023 | 1 | 7 | 1 | 0 | 0 |

| 2 Apr 2023 | 1 | 8 | 1 | 0 | 0 |

| 9 Apr 2023 | 1 | 7 | 1 | 0 | 0 |

| 16 Apr 2023 | 1 | 7 | 1 | 0 | 0 |

| 23 Apr 2023 | 1 | 6 | 1 | 0 | 0 |

| 30 Apr 2023 | 1 | 6 | 1 | 0 | 0 |

| 7 May 2023 | 1 | 6 | 1 | 0 | 0 |

| 14 May 2023 | 1 | 6 | 1 | 0 | 0 |

| 21 May 2023 | 1 | 5 | 1 | 0 | 0 |

| 28 May 2023 | 1 | 8 | 1 | 0 | 0 |

| 4 Jun 2023 | 1 | 8 | 1 | 0 | 0 |

| 11 Jun 2023 | 1 | 6 | 1 | 0 | 0 |

| 18 Jun 2023 | 1 | 8 | 1 | 0 | 0 |

| 25 Jun 2023 | 1 | 7 | 1 | 0 | 0 |

| 2 Jul 2023 | 1 | 7 | 1 | 0 | 0 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Aug 2023 | 537 |

|---|---|

| Sep 2023 | 541 |

| Oct 2023 | 490 |

| Nov 2023 | 409 |

| Dec 2023 | 346 |

| Jan 2024 | 336 |

| Feb 2024 | 318 |

| Apr 2024 | 441 |

| May 2024 | 614 |

| Jun 2024 | 622 |

| Jul 2024 | 631 |

| Aug 2023 | 18,891 |

|---|---|

| Sep 2023 | 17,987 |

| Oct 2023 | 17,987 |

| Nov 2023 | 18,891 |

| Dec 2023 | 17,880 |

| Jan 2024 | 17,880 |

| Feb 2024 | 17,129 |

| Mar 2024 | 17,333 |

| Apr 2024 | 17,333 |

| May 2024 | 16,752 |

| Jun 2024 | 16,752 |

| Jul 2024 | 16,752 |

KeyCorp other data

| Period | Buy | Sel |

|---|---|---|

| Mar 2023 | 2000 | 45000 |

| Apr 2023 | 10700 | 0 |

| May 2023 | 75000 | 25015 |

| Aug 2023 | 10000 | 0 |

| Nov 2023 | 0 | 10000 |

| Dec 2023 | 0 | 14383 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | HAYES ROBIN director | Deferred Shares | 668 | N/A | N/A | ||

Option | HAYES ROBIN director | Deferred Shares | 668 | N/A | N/A | ||

Option | HAYES ROBIN director | Common Shares | 668 | N/A | N/A | ||

Option | HAYES ROBIN director | Common Shares | 668 | N/A | N/A | ||

Option | WILSON DAVID K director | Deferred Shares | 7,705 | N/A | N/A | ||

Option | WILSON DAVID K director | Common Shares | 7,705 | N/A | N/A | ||

Option | VASOS TODD J director | Deferred Shares | 4,786 | N/A | N/A | ||

Option | VASOS TODD J director | Deferred Shares | 4,786 | N/A | N/A | ||

Option | VASOS TODD J director | Common Shares | 4,786 | N/A | N/A | ||

Option | VASOS TODD J director | Common Shares | 4,786 | N/A | N/A |

| Quarter | Transcript |

|---|---|

| Q1 2024 18 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 18 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 19 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 20 Jul 2023 | Q2 2023 Earnings Call Transcript |

JPMorgan: The Bank You Want To Own For The Next 6 Months And Maybe Forever

8 Tax-Loss Sell Alerts For December

KeyCorp's Edge: Capitalizing On Trends For 'Targeted Scale'

5 Stocks To Sell Before Tax-Loss Season Begins

KeyCorp: I Am Adding This 8.1% Yielding Regional Bank Gem Ahead Of Q3

KeyCorp - Investors Fear A 2008-Like Environment

KeyCorp: Buy The Key Support Level (Technical Analysis)

KeyCorp: Is The Juicy 7% Dividend Safe?

KeyCorp: Undervalued Bank Bargain With A 6.9% Yield

-

What's the price of KeyCorp stock today?

One share of KeyCorp stock can currently be purchased for approximately $18.14.

-

When is KeyCorp's next earnings date?

KeyCorp is estimated to report earnings on Thursday, 16 Oct 2025.

-

Does KeyCorp pay dividends?

Yes, KeyCorp pays dividends and its trailing 12-month yield is 4.77% with 620% payout ratio.It means that the company is paying a dividend greater than earnings. The last KeyCorp stock dividend of $0.2 was paid on 15 Dec 2021.

-

How much money does KeyCorp make?

KeyCorp has a market capitalization of 16.95B and it's past years’ income statements indicate that its last revenue has decreased compared to the previous period by 16.2% to 5.89B US dollars. KeyCorp earned 967M US dollars in net income (profit) last year or $0.3 on an earnings per share basis.

-

What is KeyCorp's stock symbol?

KeyCorp is traded on the NYSE under the ticker symbol "KEY".

-

What is KeyCorp's primary industry?

Company operates in the Financial Services sector and Banks - Regional industry.

-

How do i buy shares of KeyCorp?

Shares of KeyCorp can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are KeyCorp's key executives?

KeyCorp's management team includes the following people:

- Mr. Donald R. Kimble Jr. Chief Financial Officer & Chief Admin. Officer(age: 65, pay: $2,720,000)

- Mr. Christopher Marrott Gorman Chairman, Pres & Chief Executive Officer(age: 64, pay: $2,670,000)

- Mr. Andrew Jackson Paine III Executive Vice President & Pres of Key Institutional Bank(age: 55, pay: $2,070,000)

- Ms. Amy G. Brady Chief Information Officer & Executive Vice President(age: 58, pay: $1,800,000)

- Ms. Angela G. Mago Head of Commercial Bank(age: 59, pay: $1,770,000)

-

How many employees does KeyCorp have?

As Jul 2024, KeyCorp employs 16,752 workers, which is 3% less then previous quarter.

-

When KeyCorp went public?

KeyCorp is publicly traded company for more then 38 years since IPO on 5 Nov 1987.

-

What is KeyCorp's official website?

The official website for KeyCorp is key.com.

-

Where are KeyCorp's headquarters?

KeyCorp is headquartered at 127 Public Square, Cleveland, OH.

-

How can i contact KeyCorp?

KeyCorp's mailing address is 127 Public Square, Cleveland, OH and company can be reached via phone at +216 6893000.

-

What is KeyCorp stock forecast & price target?

Based on 10 Wall Street analysts` predicted price targets for KeyCorp in the last 12 months, the avarage price target is $18.6. The average price target represents a 2.53% change from the last price of $18.14.

KeyCorp company profile:

KeyCorp

key.comNYSE

16,734

Banks - Regional

Financial Services

KeyCorp operates as the holding company for KeyBank National Association that provides various retail and commercial banking products and services in the United States. It operates in two segments, Consumer Bank and Commercial Bank. The company offers various deposits, investment products and services; and personal finance and financial wellness, student loan refinancing, mortgage and home equity, lending, credit card, treasury, business advisory, wealth management, asset management, investment, cash management, portfolio management, and trust and related services to individuals and small and medium-sized businesses. It also provides a suite of banking and capital market products, such as syndicated finance, debt and equity capital market products, commercial payments, equipment finance, commercial mortgage banking, derivatives, foreign exchange, financial advisory, and public finance, as well as commercial mortgage loans comprising consumer, energy, healthcare, industrial, public sector, real estate, and technology loans for middle market clients. In addition, the company offers community development financing, securities underwriting, brokerage, and investment banking services. As of December 31, 2021, it operated through a network of approximately 999 branches and 1,317 ATMs in 15 states, as well as additional offices, online and mobile banking capabilities, and a telephone banking call center. KeyCorp was founded in 1849 and is headquartered in Cleveland, Ohio.

Cleveland, OH 44114-1306

CIK: 0000091576

ISIN: US4932671088

CUSIP: 493267108