Next earnings date: 22 Oct 2025

M&T Bank Corporation – NYSE:MTB

M&T Bank stock price today

M&T Bank stock price monthly change

M&T Bank stock price quarterly change

M&T Bank stock price yearly change

M&T Bank key metrics

Market Cap | 31.32B |

Enterprise value | 43.36B |

P/E | 13.19 |

EV/Sales | 3.83 |

EV/EBITDA | 16.59 |

Price/Sales | 2.77 |

Price/Book | 1.09 |

PEG ratio | -96.62 |

EPS | 15.02 |

Revenue | 10.31B |

EBITDA | 3.46B |

Income | 2.57B |

Revenue Q/Q | 38.23% |

Revenue Y/Y | 14.60% |

Profit margin | 21.13% |

Oper. margin | 28.1% |

Gross margin | 100% |

EBIT margin | 28.1% |

EBITDA margin | 33.6% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeM&T Bank stock price history

M&T Bank stock forecast

M&T Bank financial statements

$211.7

Potential upside: 11.09%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 2.37B | 867.03M | 36.47% |

|---|---|---|---|

| Sep 2023 | 2.33B | 689.94M | 29.55% |

| Dec 2023 | 2.28B | 482.40M | 21.15% |

| Mar 2024 | 3.32B | 531M | 15.97% |

| 2024-10-17 | 3.64 | 4.02 |

|---|

| Payout ratio | 42.28% |

|---|

| 2019 | 2.72% |

|---|---|

| 2020 | 3.89% |

| 2021 | 3.28% |

| 2022 | 3.72% |

| 2023 | 4.24% |

| Jun 2023 | 207671729000 | 181.87B | 87.58% |

|---|---|---|---|

| Sep 2023 | 209124000000 | 182.92B | 87.47% |

| Dec 2023 | 208264000000 | 181.30B | 87.06% |

| Mar 2024 | 215137000000 | 187.96B | 87.37% |

| Jun 2023 | 1.25B | -4.90B | 3.67B |

|---|---|---|---|

| Sep 2023 | 1.41B | -1.90B | 408.27M |

| Dec 2023 | 800.27M | 682.90M | -1.52B |

| Mar 2024 | 821M | -7.29B | 6.43B |

M&T Bank alternative data

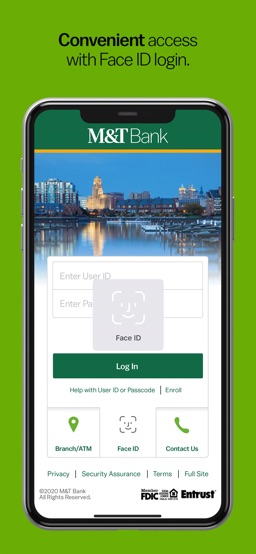

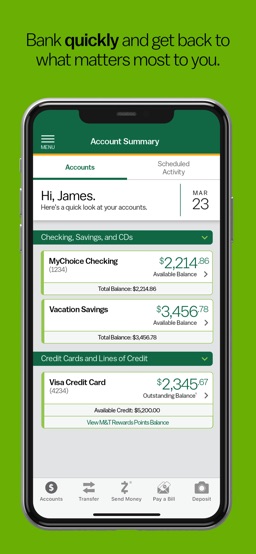

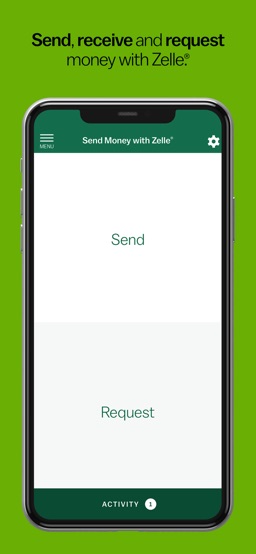

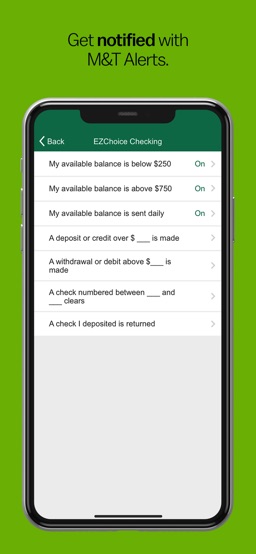

M&T Mobile Banking

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| May 2024 | 199 |

|---|

| Aug 2023 | 172 |

|---|---|

| Sep 2023 | 170 |

| Oct 2023 | 189 |

| Nov 2023 | 198 |

| Dec 2023 | 205 |

| Jan 2024 | 218 |

| Feb 2024 | 226 |

| Mar 2024 | 236 |

| Apr 2024 | 186 |

| May 2024 | 190 |

| Jun 2024 | 202 |

| Jul 2024 | 176 |

| Aug 2024 | 188 |

| Sep 2024 | 226 |

| Oct 2024 | 248 |

| Nov 2024 | 231 |

| Dec 2024 | 239 |

M&T Bank Social Media Accounts

| May 2025 | 9049 |

|---|---|

| Jul 2025 | 9518 |

| Aug 2025 | 9618 |

M&T Bank Business Products & Services

| 12 Feb 2023 | 53 | 44 | 17 | 56 |

|---|---|---|---|---|

| 19 Feb 2023 | 52 | 49 | 18 | 52 |

| 26 Feb 2023 | 50 | 41 | 21 | 65 |

| 5 Mar 2023 | 53 | 51 | 18 | 64 |

| 12 Mar 2023 | 52 | 47 | 23 | 65 |

| 19 Mar 2023 | 49 | 49 | 23 | 64 |

| 26 Mar 2023 | 51 | 43 | 25 | 77 |

| 2 Apr 2023 | 48 | 47 | 24 | 72 |

| 9 Apr 2023 | 46 | 47 | 24 | 70 |

| 16 Apr 2023 | 45 | 42 | 24 | 67 |

| 23 Apr 2023 | 50 | 44 | 22 | 67 |

| 30 Apr 2023 | 47 | 39 | 23 | 66 |

| 7 May 2023 | 44 | 39 | 21 | 69 |

| 14 May 2023 | 42 | 41 | 23 | 65 |

| 21 May 2023 | 39 | 40 | 22 | 62 |

| 28 May 2023 | 32 | 37 | 24 | 62 |

| 4 Jun 2023 | 44 | 42 | 23 | 71 |

| 11 Jun 2023 | 41 | 42 | 24 | 66 |

| 18 Jun 2023 | 41 | 40 | 23 | 66 |

| 25 Jun 2023 | 38 | 31 | 16 | 58 |

M&T Bank Personal Products & Services

| 12 Feb 2023 | 7 | 10 | 10 | 2 |

|---|---|---|---|---|

| 19 Feb 2023 | 6 | 10 | 9 | 2 |

| 26 Feb 2023 | 6 | 10 | 8 | 2 |

| 5 Mar 2023 | 6 | 10 | 8 | 1 |

| 12 Mar 2023 | 6 | 11 | 7 | 1 |

| 19 Mar 2023 | 6 | 10 | 8 | 1 |

| 26 Mar 2023 | 6 | 9 | 7 | 1 |

| 2 Apr 2023 | 6 | 11 | 7 | 1 |

| 9 Apr 2023 | 6 | 10 | 7 | 1 |

| 16 Apr 2023 | 5 | 10 | 6 | 1 |

| 23 Apr 2023 | 6 | 10 | 6 | 1 |

| 30 Apr 2023 | 6 | 9 | 6 | 1 |

| 7 May 2023 | 5 | 10 | 6 | 1 |

| 14 May 2023 | 6 | 9 | 8 | 1 |

| 21 May 2023 | 6 | 9 | 8 | 1 |

| 28 May 2023 | 4 | 8 | 6 | 1 |

| 4 Jun 2023 | 5 | 9 | 8 | 1 |

| 11 Jun 2023 | 5 | 9 | 7 | 1 |

| 18 Jun 2023 | 5 | 10 | 7 | 1 |

| 25 Jun 2023 | 5 | 8 | 7 | 1 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 492 |

|---|---|

| Oct 2023 | 633 |

| Nov 2023 | 680 |

| Dec 2023 | 710 |

| Jan 2024 | 682 |

| Feb 2024 | 707 |

| Apr 2024 | 890 |

| May 2024 | 807 |

| Jun 2024 | 840 |

| Jul 2024 | 829 |

| Dec 2024 | 950 |

| Jan 2025 | 910 |

| Feb 2025 | 847 |

| May 2025 | 931 |

| Jul 2025 | 781 |

| Aug 2025 | 767 |

| Sep 2023 | 22,946 |

|---|---|

| Oct 2023 | 22,946 |

| Nov 2023 | 22,210 |

| Dec 2023 | 22,424 |

| Jan 2024 | 22,424 |

| Feb 2024 | 22,424 |

| Mar 2024 | 21,736 |

| Apr 2024 | 21,736 |

| May 2024 | 21,736 |

| Jun 2024 | 21,927 |

| Jul 2024 | 21,927 |

M&T Bank other data

| Period | Buy | Sel |

|---|---|---|

| Feb 2024 | 0 | 2675 |

| Mar 2024 | 0 | 33509 |

| Apr 2024 | 0 | 21638 |

| May 2024 | 0 | 145306 |

| Jul 2024 | 0 | 8972 |

| Aug 2024 | 0 | 66144 |

| Sep 2024 | 0 | 10000 |

| Oct 2024 | 0 | 51362 |

| Nov 2024 | 0 | 72291 |

| Dec 2024 | 0 | 2490 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Sale | GEISEL GARY N director, other: Vice Chairman | Common Stock | 2,490 | $215.89 | $537,566 | ||

Option | WOODROW TRACY S. officer: Sr. Executive Vice Pre.. | Common Stock | 2,121 | $132.47 | $280,969 | ||

Sale | WOODROW TRACY S. officer: Sr. Executive Vice Pre.. | Common Stock | 2,121 | $220.75 | $468,200 | ||

Option | WOODROW TRACY S. officer: Sr. Executive Vice Pre.. | Option (right to buy) | 2,121 | $132.47 | $280,969 | ||

Sale | SALAMONE DENIS J director | Common Stock | 10,000 | $223.41 | $2,234,050 | ||

Sale | BARNES JOHN P director | Common Stock | 17,094 | $217.63 | $3,720,219 | ||

Sale | BARNES JOHN P director | Common Stock | 17,094 | $217.63 | $3,720,219 | ||

Sale | BARNES JOHN P director | Common Stock | 17,094 | $217.63 | $3,720,219 | ||

Sale | BARNES JOHN P director | Common Stock | 2,906 | $216.38 | $628,812 | ||

Sale | BARNES JOHN P director | Common Stock | 2,906 | $216.38 | $628,812 |

| Quarter | Transcript |

|---|---|

| Q1 2024 15 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 18 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 18 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 19 Jul 2023 | Q2 2023 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

Mr. Rene F. Jones CPA (1965) Chairman & Chief Executive Officer | $1,920,000 |

| Mr. Kevin J. Pearson (1962) Vice Chairman & Director | $1,460,000 |

| Mr. Richard S. Gold (1961) Pres, Chief Operating Officer & Director | $1,460,000 |

| Mr. Darren J. King (1970) Executive Vice President & Chief Financial Officer | $1,310,000 |

| Ms. Doris Powers Meister (1956) Executive Vice President of Wealth & Institutional Services | $1,240,000 |

Undercovered Dozen: Power Metals, Verses AI, TFS Financial, Nextdoor +

A Quest That Has Translated Into New Investments

Undercovered Dozen: Telus Corporation, X-FAB Silicon Foundries, GRAIL, And More

PNC Financial: Undramatic, Undervalued, And Underrated

M&T Bank: Buy The Dip

M&T Bank Hasn't Seen The Price Growth It Deserves

Q3 List Of Banks And Their Increasing Paper Losses In Their Debt Securities Portfolios

Regions Financial Showing Its All-Weather Qualities

Why M&T Bank Is A Strong Buy And A Hidden Value Opportunity

-

What's the price of M&T Bank stock today?

One share of M&T Bank stock can currently be purchased for approximately $190.55.

-

When is M&T Bank's next earnings date?

M&T Bank Corporation is estimated to report earnings on Wednesday, 22 Oct 2025.

-

Does M&T Bank pay dividends?

Yes, M&T Bank pays dividends and its trailing 12-month yield is 2.83% with 42% payout ratio. The last M&T Bank stock dividend of $1.2 was paid on 31 Dec 2021.

-

How much money does M&T Bank make?

M&T Bank has a market capitalization of 31.32B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 11.88% to 9B US dollars. M&T Bank earned 2.74B US dollars in net income (profit) last year or $4.02 on an earnings per share basis.

-

What is M&T Bank's stock symbol?

M&T Bank Corporation is traded on the NYSE under the ticker symbol "MTB".

-

What is M&T Bank's primary industry?

Company operates in the Financial Services sector and Banks - Regional industry.

-

How do i buy shares of M&T Bank?

Shares of M&T Bank can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are M&T Bank's key executives?

M&T Bank's management team includes the following people:

- Mr. Rene F. Jones CPA Chairman & Chief Executive Officer(age: 60, pay: $1,920,000)

- Mr. Kevin J. Pearson Vice Chairman & Director(age: 63, pay: $1,460,000)

- Mr. Richard S. Gold Pres, Chief Operating Officer & Director(age: 64, pay: $1,460,000)

- Mr. Darren J. King Executive Vice President & Chief Financial Officer(age: 55, pay: $1,310,000)

- Ms. Doris Powers Meister Executive Vice President of Wealth & Institutional Services(age: 69, pay: $1,240,000)

-

How many employees does M&T Bank have?

As Jul 2024, M&T Bank employs 21,927 workers, which is 1% more then previous quarter.

-

When M&T Bank went public?

M&T Bank Corporation is publicly traded company for more then 45 years since IPO on 17 Mar 1980.

-

What is M&T Bank's official website?

The official website for M&T Bank is www3.mtb.com.

-

Where are M&T Bank's headquarters?

M&T Bank is headquartered at One M&T Plaza, Buffalo, NY.

-

How can i contact M&T Bank?

M&T Bank's mailing address is One M&T Plaza, Buffalo, NY and company can be reached via phone at +7 166354000.

-

What is M&T Bank stock forecast & price target?

Based on 10 Wall Street analysts` predicted price targets for M&T Bank in the last 12 months, the avarage price target is $211.7. The average price target represents a 11.09% change from the last price of $190.55.

M&T Bank company profile:

M&T Bank Corporation

www3.mtb.comNYSE

21,986

Banks - Regional

Financial Services

M&T Bank Corporation operates as a bank holding company that provides commercial and retail banking services. The company's Business Banking segment offers deposit, lending, cash management, and other financial services to small businesses and professionals. Its Commercial Banking segment provides deposit products, commercial lending and leasing, letters of credit, and cash management services for middle-market and large commercial customers. The company's Commercial Real Estate segment originates, sells, and services commercial real estate loans; and offers deposit services. Its Discretionary Portfolio segment provides deposits; securities, residential real estate loans, and other assets; and short and long term borrowed funds, as well as foreign exchange services. The company's Residential Mortgage Banking segment offers residential real estate loans for consumers and sells those loans in the secondary market; and purchases servicing rights to loans originated by other entities. Its Retail Banking segment offers demand, savings, and time accounts; consumer installment loans, automobile and recreational finance loans, home equity loans and lines of credit, and credit cards; mutual funds and annuities; and other services. The company also provides trust and wealth management; fiduciary and custodial; insurance agency; institutional brokerage and securities; and investment management services. It offers its services through banking offices, business banking centers, telephone and internet banking, and automated teller machines. As of December 31, 2021, the company operates 688 domestic banking offices in New York State, Maryland, New Jersey, Pennsylvania, Delaware, Connecticut, Virginia, West Virginia, and the District of Columbia; and a full-service commercial banking office in Ontario, Canada. M&T Bank Corporation was founded in 1856 and is headquartered in Buffalo, New York.

Buffalo, NY 14203

CIK: 0000036270

ISIN: US55261F1049

CUSIP: 55261F104