Next earnings date: 14 Oct 2025

Synchrony Financial – NYSE:SYF

Synchrony Financial stock price today

Synchrony Financial stock price monthly change

Synchrony Financial stock price quarterly change

Synchrony Financial stock price yearly change

Synchrony Financial key metrics

Market Cap | 25.33B |

Enterprise value | 23.36B |

P/E | 8.17 |

EV/Sales | 1.27 |

EV/EBITDA | 10.71 |

Price/Sales | 1.40 |

Price/Book | 1.61 |

PEG ratio | -21.65 |

EPS | 7.02 |

Revenue | 18.26B |

EBITDA | 6.92B |

Income | 2.93B |

Revenue Q/Q | 44.82% |

Revenue Y/Y | 12.59% |

Profit margin | 17.27% |

Oper. margin | 45.41% |

Gross margin | 78.58% |

EBIT margin | 45.41% |

EBITDA margin | 37.9% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeSynchrony Financial stock price history

Synchrony Financial stock forecast

Synchrony Financial financial statements

$58.14

Potential downside: -18.24%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 3.29B | 569M | 17.27% |

|---|---|---|---|

| Sep 2023 | 5.35B | 628M | 11.73% |

| Dec 2023 | 3.65B | 440M | 12.03% |

| Mar 2024 | 5.96B | 1.29B | 21.69% |

| 2024-10-16 | 1.79 | 1.94 |

|---|

| Payout ratio | 14.72% |

|---|

| 2019 | 2.41% |

|---|---|

| 2020 | 2.75% |

| 2021 | 2.07% |

| 2022 | 3.02% |

| 2023 | 2.79% |

| Jun 2023 | 108697000000 | 95.31B | 87.69% |

|---|---|---|---|

| Sep 2023 | 112939000000 | 99.17B | 87.81% |

| Dec 2023 | 117479000000 | 103.57B | 88.17% |

| Mar 2024 | 121173000000 | 105.89B | 87.39% |

| Jun 2023 | 1.90B | -5.18B | 216M |

|---|---|---|---|

| Sep 2023 | 2.48B | -2.56B | 3.03B |

| Dec 2023 | 2.31B | -7.16B | 3.47B |

| Mar 2024 | 2.24B | 798M | 2.60B |

Synchrony Financial alternative data

| Aug 2023 | 251 |

|---|---|

| Sep 2023 | 231 |

| Oct 2023 | 256 |

| Nov 2023 | 201 |

| Dec 2023 | 232 |

| Jan 2024 | 244 |

| Feb 2024 | 253 |

| Mar 2024 | 261 |

| Apr 2024 | 232 |

| May 2024 | 258 |

| Jun 2024 | 262 |

| Jul 2024 | 277 |

| Aug 2024 | 320 |

| Sep 2024 | 322 |

| Oct 2024 | 348 |

| Nov 2024 | 348 |

| Dec 2024 | 329 |

Synchrony Financial Social Media Accounts

| May 2025 | 16110 |

|---|---|

| Jul 2025 | 16827 |

| Aug 2025 | 17139 |

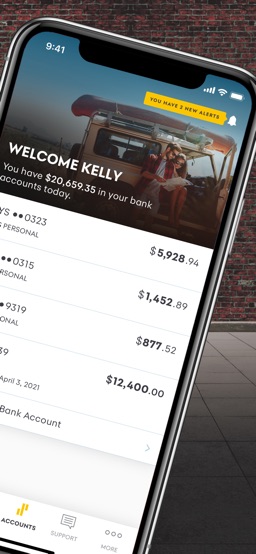

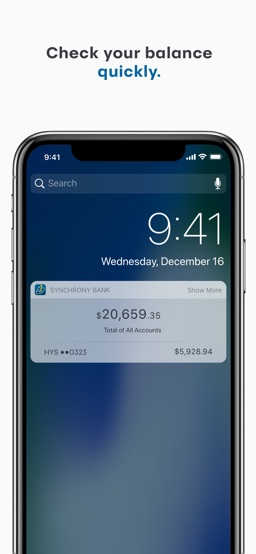

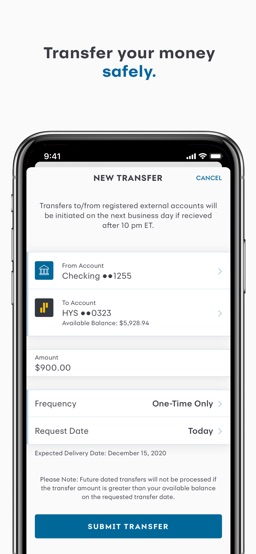

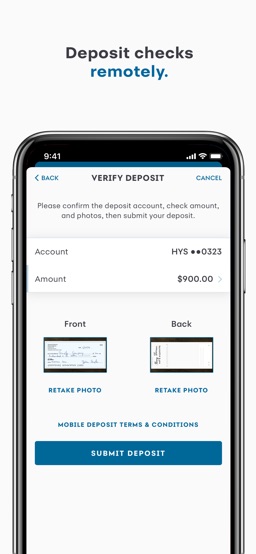

Synchrony Bank

| 19 Feb 2023 | 46 |

|---|---|

| 26 Feb 2023 | 44 |

| 5 Mar 2023 | 41 |

| 12 Mar 2023 | 40 |

| 19 Mar 2023 | 50 |

| 26 Mar 2023 | 48 |

| 2 Apr 2023 | 50 |

| 9 Apr 2023 | 44 |

| 16 Apr 2023 | 50 |

| 23 Apr 2023 | 48 |

| 30 Apr 2023 | 46 |

| 7 May 2023 | 44 |

| 14 May 2023 | 43 |

| 21 May 2023 | 47 |

| 28 May 2023 | 46 |

| 4 Jun 2023 | 45 |

| 11 Jun 2023 | 39 |

| 18 Jun 2023 | 53 |

| 25 Jun 2023 | 50 |

| 2 Jul 2023 | 48 |

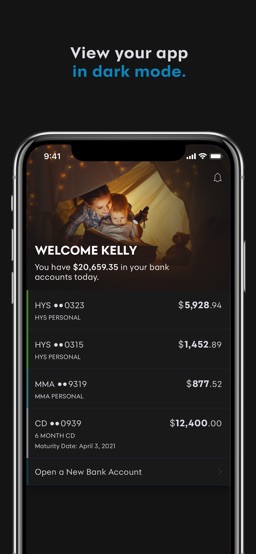

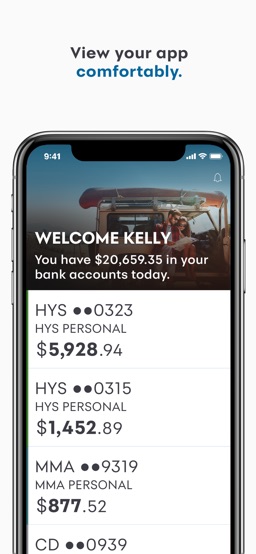

Synchrony Financial Products

| 16 Jul 2023 | 0 |

|---|---|

| 23 Jul 2023 | 86 |

| 30 Jul 2023 | 75 |

| 6 Aug 2023 | 78 |

| 13 Aug 2023 | 87 |

| 20 Aug 2023 | 81 |

| 27 Aug 2023 | 88 |

| 3 Sep 2023 | 82 |

| 10 Sep 2023 | 88 |

| 17 Sep 2023 | 88 |

| 24 Sep 2023 | 80 |

| 1 Oct 2023 | 85 |

| 8 Oct 2023 | 82 |

| 15 Oct 2023 | 82 |

| 22 Oct 2023 | 77 |

| 29 Oct 2023 | 78 |

| 5 Nov 2023 | 78 |

| 12 Nov 2023 | 92 |

| 19 Nov 2023 | 81 |

| 26 Nov 2023 | 84 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Aug 2023 | 57 |

|---|---|

| Sep 2023 | 55 |

| Oct 2023 | 49 |

| Nov 2023 | 36 |

| Dec 2023 | 47 |

| Jan 2024 | 47 |

| Feb 2024 | 90 |

| Apr 2024 | 50 |

| May 2024 | 59 |

| Jun 2024 | 67 |

| Jul 2024 | 516 |

| Dec 2024 | 619 |

| Jan 2025 | 495 |

| Aug 2023 | 18,500 |

|---|---|

| Sep 2023 | 18,500 |

| Oct 2023 | 18,500 |

| Nov 2023 | 18,500 |

| Dec 2023 | 18,500 |

| Jan 2024 | 18,500 |

| Feb 2024 | 18,500 |

| Mar 2024 | 20,000 |

| Apr 2024 | 20,000 |

| May 2024 | 20,000 |

| Jun 2024 | 20,000 |

| Jul 2024 | 20,000 |

Synchrony Financial other data

| Period | Buy | Sel |

|---|---|---|

| Dec 2023 | 0 | 26443 |

| Feb 2024 | 0 | 7283 |

| Aug 2024 | 0 | 76071 |

| Nov 2024 | 0 | 56097 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | MOTHNER JONATHAN S officer: See remarks | Common Stock | 16,163 | $30.41 | $491,517 | ||

Sale | MOTHNER JONATHAN S officer: See remarks | Common Stock | 16,163 | $64.99 | $1,050,433 | ||

Sale | MOTHNER JONATHAN S officer: See remarks | Common Stock | 18,000 | $64.99 | $1,169,820 | ||

Option | MOTHNER JONATHAN S officer: See remarks | Employee Stock Option (right to buy) | 16,163 | $30.41 | $491,517 | ||

Sale | HOWSE CURTIS officer: See remarks | Common Stock | 21,934 | $55.13 | $1,209,221 | ||

Option | WENZEL BRIAN J. SR. officer: See rema.. | Common Stock | 8,490 | $29.33 | $249,012 | ||

Option | WENZEL BRIAN J. SR. officer: See rema.. | Common Stock | 8,490 | $29.33 | $249,012 | ||

Option | WENZEL BRIAN J. SR. officer: See rema.. | Common Stock | 8,490 | $29.33 | $249,012 | ||

Sale | WENZEL BRIAN J. SR. officer: See rema.. | Common Stock | 74,698 | $46.73 | $3,490,638 | ||

Sale | WENZEL BRIAN J. SR. officer: See rema.. | Common Stock | 74,698 | $46.73 | $3,490,638 |

| Quarter | Transcript |

|---|---|

| Q1 2024 24 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 23 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 24 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 18 Jul 2023 | Q2 2023 Earnings Call Transcript |

Discover Financial: Strong Fundamentals And Strategic Outlook

Synchrony Financial: An Attractive Play On Positive Catalysts

Synchrony Financial: Finally Getting Credit

American Express: Growing And Returning Shareholder Value

Synchrony Financial: Slowing A Little But Still A Good Deal

Credit Acceptance: There Are Better Opportunities

Synchrony: A Buy As Credit Deterioration Slows

Synchrony Financial: Regional Headwinds Overblown, Creating Great Value Opportunity

Katapult Synergy 2023

-

What's the price of Synchrony Financial stock today?

One share of Synchrony Financial stock can currently be purchased for approximately $71.12.

-

When is Synchrony Financial's next earnings date?

Synchrony Financial is estimated to report earnings on Tuesday, 14 Oct 2025.

-

Does Synchrony Financial pay dividends?

Yes, Synchrony Financial pays dividends and its trailing 12-month yield is 1.52% with 15% payout ratio. The last Synchrony Financial stock dividend of $0.22 was paid on 17 Feb 2022.

-

How much money does Synchrony Financial make?

Synchrony Financial has a market capitalization of 25.33B and it's past years’ income statements indicate that its last revenue has decreased compared to the previous period by 52.13% to 7.66B US dollars. Synchrony Financial earned 2.24B US dollars in net income (profit) last year or $1.94 on an earnings per share basis.

-

What is Synchrony Financial's stock symbol?

Synchrony Financial is traded on the NYSE under the ticker symbol "SYF".

-

What is Synchrony Financial's primary industry?

Company operates in the Financial Services sector and Financial - Credit Services industry.

-

How do i buy shares of Synchrony Financial?

Shares of Synchrony Financial can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are Synchrony Financial's key executives?

Synchrony Financial's management team includes the following people:

- Ms. Margaret M. Keane Executive Chair of the Board(age: 66, pay: $3,940,000)

- Mr. Brian D. Doubles Pres, Chief Executive Officer & Director(age: 49, pay: $2,180,000)

- Mr. Thomas M. Quindlen Executive Vice President and Chief Executive Officer of Diversified, Value & Lifestyle(age: 63, pay: $1,940,000)

- Mr. Brian J. Wenzel Sr. Executive Vice President & Chief Financial Officer(age: 57, pay: $1,460,000)

-

How many employees does Synchrony Financial have?

As Jul 2024, Synchrony Financial employs 20,000 workers.

-

When Synchrony Financial went public?

Synchrony Financial is publicly traded company for more then 11 years since IPO on 31 Jul 2014.

-

What is Synchrony Financial's official website?

The official website for Synchrony Financial is synchrony.com.

-

Where are Synchrony Financial's headquarters?

Synchrony Financial is headquartered at 777 Long Ridge Road, Stamford, CT.

-

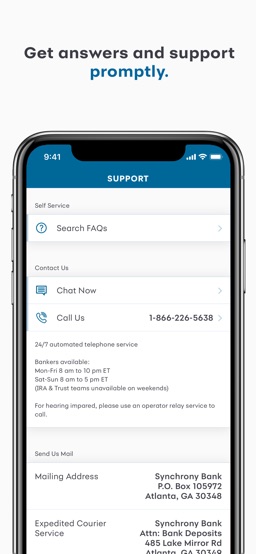

How can i contact Synchrony Financial?

Synchrony Financial's mailing address is 777 Long Ridge Road, Stamford, CT and company can be reached via phone at +20 3 5852400.

-

What is Synchrony Financial stock forecast & price target?

Based on 6 Wall Street analysts` predicted price targets for Synchrony Financial in the last 12 months, the avarage price target is $58.14. The average price target represents a -18.24% change from the last price of $71.12.

Synchrony Financial company profile:

Synchrony Financial

synchrony.comNYSE

20,000

Financial - Credit Services

Financial Services

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans. The company also offers private label credit cards, dual cards, co-brand and general purpose credit cards, short- and long-term installment loans, and consumer banking products; and deposit products, including certificates of deposit, individual retirement accounts, money market accounts, and savings accounts to retail and commercial customers, as well as accepts deposits through third-party securities brokerage firms. In addition, it provides debt cancellation products to its credit card customers through online, mobile, and direct mail; healthcare payments and financing solutions under the CareCredit, Pets Best, and Walgreens brands; payments and financing solutions in the apparel, specialty retail, outdoor, music, and luxury industries; and point-of-sale consumer financing for audiology products and dental services. The company offers its credit products through programs established with a group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers; and deposit products through various channels, such as digital and print. It serves digital, health and wellness, retail, home, auto, powersports, jewelry, pets, and other industries. Synchrony Financial was founded in 1932 and is headquartered in Stamford, Connecticut.

Stamford, CT 06902

CIK: 0001601712

ISIN: US87165B1035

CUSIP: 87165B103