Next earnings date: 16 Oct 2025

U.S. Bancorp – NYSE:USB

U.S. Bancorp stock price today

U.S. Bancorp stock price monthly change

U.S. Bancorp stock price quarterly change

U.S. Bancorp stock price yearly change

U.S. Bancorp key metrics

Market Cap | 74.57B |

Enterprise value | 80.63B |

P/E | 13.69 |

EV/Sales | 2.36 |

EV/EBITDA | 10.57 |

Price/Sales | 2.21 |

Price/Book | 1.27 |

PEG ratio | 0.13 |

EPS | 3.02 |

Revenue | 31.33B |

EBITDA | 7.83B |

Income | 5.05B |

Revenue Q/Q | 46.53% |

Revenue Y/Y | 49.02% |

Profit margin | 16.06% |

Oper. margin | 21.43% |

Gross margin | 100.38% |

EBIT margin | 21.43% |

EBITDA margin | 25.01% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeU.S. Bancorp stock price history

U.S. Bancorp stock forecast

U.S. Bancorp financial statements

$53.5

Potential upside: 15.62%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 7.14B | 1.36B | 19.06% |

|---|---|---|---|

| Sep 2023 | 7B | 1.52B | 21.76% |

| Dec 2023 | 6.73B | 847M | 12.58% |

| Mar 2024 | 10.46B | 1.31B | 12.61% |

| 2024-10-16 | 0.99 | 1.03 |

|---|

| Payout ratio | 62.28% |

|---|

| 2019 | 2.93% |

|---|---|

| 2020 | 4.06% |

| 2021 | 3.45% |

| 2022 | 4.74% |

| 2023 | 4.96% |

| Jun 2023 | 680825000000 | 627.34B | 92.14% |

|---|---|---|---|

| Sep 2023 | 668039000000 | 614.46B | 91.98% |

| Dec 2023 | 663491000000 | 607.72B | 91.59% |

| Mar 2024 | 683606000000 | 627.57B | 91.8% |

| Jun 2023 | 3.31B | 6.54B | -5.44B |

|---|---|---|---|

| Sep 2023 | 3.87B | 5.63B | -15.79B |

| Dec 2023 | 416M | 1.8B | -5.37B |

| Mar 2024 | 2.66B | -4.95B | 18.08B |

U.S. Bancorp alternative data

U.S. Bank ReliaCard

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 182 |

|---|---|

| Sep 2023 | 174 |

| Oct 2023 | 197 |

| Dec 2023 | 172 |

| Feb 2024 | 191 |

| May 2024 | 191 |

| Jul 2024 | 170 |

| Oct 2024 | 193 |

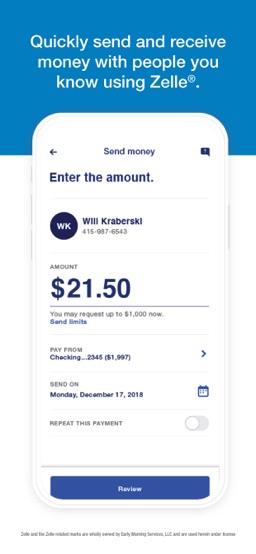

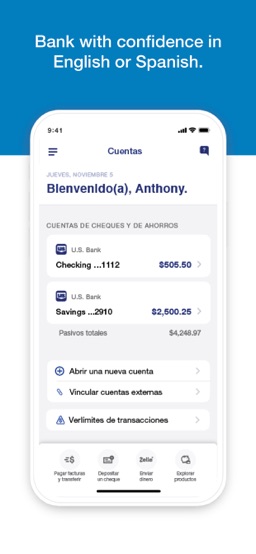

U.S. Bank Mobile: Bank and Invest

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 43 |

|---|---|

| Sep 2023 | 34 |

| Oct 2023 | 44 |

| Nov 2023 | 39 |

| Dec 2023 | 31 |

| Jan 2024 | 52 |

| Feb 2024 | 42 |

| Mar 2024 | 47 |

| Apr 2024 | 69 |

| May 2024 | 59 |

| Jun 2024 | 50 |

| Jul 2024 | 56 |

| Aug 2024 | 46 |

| Sep 2024 | 45 |

| Oct 2024 | 45 |

| Nov 2024 | 44 |

| Dec 2024 | 53 |

| Aug 2023 | 35 |

|---|---|

| Sep 2023 | 36 |

| Oct 2023 | 46 |

| Nov 2023 | 48 |

| Dec 2023 | 55 |

| Jan 2024 | 52 |

| Feb 2024 | 46 |

| Mar 2024 | 55 |

| Apr 2024 | 53 |

| May 2024 | 53 |

| Jun 2024 | 55 |

| Jul 2024 | 51 |

| Aug 2024 | 44 |

| Sep 2024 | 55 |

| Oct 2024 | 45 |

| Nov 2024 | 48 |

| Dec 2024 | 52 |

U.S. Bancorp Social Media Accounts

| Aug 2023 | 343245 |

|---|---|

| Sep 2023 | 344639 |

| Oct 2023 | 346879 |

| May 2025 | 63826 |

|---|---|

| Jul 2025 | 64840 |

| Aug 2025 | 65398 |

US Bankcorp

| 21 May 2023 | 57 |

|---|---|

| 28 May 2023 | 53 |

| 4 Jun 2023 | 53 |

| 11 Jun 2023 | 50 |

| 18 Jun 2023 | 55 |

| 25 Jun 2023 | 49 |

| 2 Jul 2023 | 51 |

| 9 Jul 2023 | 48 |

| 16 Jul 2023 | 51 |

| 23 Jul 2023 | 48 |

| 30 Jul 2023 | 50 |

| 6 Aug 2023 | 45 |

| 13 Aug 2023 | 46 |

| 20 Aug 2023 | 61 |

| 27 Aug 2023 | 49 |

| 3 Sep 2023 | 45 |

| 10 Sep 2023 | 38 |

| 17 Sep 2023 | 50 |

| 24 Sep 2023 | 46 |

| 1 Oct 2023 | 46 |

US Bank Products

| 14 May 2023 | 50 | 1 | 76 |

|---|---|---|---|

| 21 May 2023 | 53 | 1 | 83 |

| 28 May 2023 | 49 | 1 | 75 |

| 4 Jun 2023 | 45 | 1 | 76 |

| 11 Jun 2023 | 44 | 1 | 76 |

| 18 Jun 2023 | 45 | 1 | 80 |

| 25 Jun 2023 | 42 | 1 | 74 |

| 2 Jul 2023 | 41 | 1 | 77 |

| 9 Jul 2023 | 40 | 1 | 74 |

| 16 Jul 2023 | 40 | 1 | 76 |

| 23 Jul 2023 | 40 | 1 | 75 |

| 30 Jul 2023 | 39 | 1 | 74 |

| 6 Aug 2023 | 40 | 1 | 68 |

| 13 Aug 2023 | 36 | 1 | 72 |

| 20 Aug 2023 | 37 | 1 | 61 |

| 27 Aug 2023 | 39 | 1 | 71 |

| 3 Sep 2023 | 35 | 0 | 64 |

| 10 Sep 2023 | 41 | 1 | 76 |

| 17 Sep 2023 | 37 | 1 | 70 |

| 24 Sep 2023 | 37 | 1 | 69 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Aug 2023 | 1,789 |

|---|---|

| Sep 2023 | 2,125 |

| Oct 2023 | 1,815 |

| Nov 2023 | 1,726 |

| Dec 2023 | 1,323 |

| Jan 2024 | 1,167 |

| Feb 2024 | 1,331 |

| Apr 2024 | 1,395 |

| May 2024 | 2,160 |

| Jun 2024 | 1,994 |

| Jul 2024 | 32 |

| Aug 2023 | 76,646 |

|---|---|

| Sep 2023 | 77,000 |

| Oct 2023 | 77,000 |

| Nov 2023 | 75,000 |

| Dec 2023 | 75,000 |

| Jan 2024 | 75,000 |

| Feb 2024 | 70,000 |

| Mar 2024 | 75,465 |

| Apr 2024 | 75,465 |

| May 2024 | 70,000 |

| Jun 2024 | 70,000 |

| Jul 2024 | 70,000 |

U.S. Bancorp other data

| Period | Buy | Sel |

|---|---|---|

| Apr 2023 | 40438 | 0 |

| May 2023 | 36260 | 0 |

| Aug 2023 | 0 | 39816 |

| Dec 2023 | 0 | 32756 |

| Jan 2024 | 0 | 38683 |

| Feb 2024 | 0 | 114948 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | CHOSY JAMES L officer: Senior E.. | Common Stock, $0.01 par value | 21,969 | $40.32 | $885,790 | ||

Sale | CHOSY JAMES L officer: Senior E.. | Common Stock, $0.01 par value | 21,582 | $41.47 | $895,070 | ||

Option | CHOSY JAMES L officer: Senior E.. | Employee Stock Option (Right to Buy) | 21,969 | $40.32 | $885,790 | ||

Option | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $40.32 | $3,764,517 | ||

Option | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $40.32 | $3,764,517 | ||

Option | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $40.32 | $3,764,517 | ||

Sale | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $41.35 | $3,860,871 | ||

Sale | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $41.35 | $3,860,871 | ||

Sale | CECERE ANDREW director, officer.. | Common Stock, $0.01 par value | 93,366 | $41.35 | $3,860,871 | ||

Option | CECERE ANDREW director, officer.. | Employee Stock Option (Right to Buy) | 93,366 | $40.32 | $3,764,517 |

| Quarter | Transcript |

|---|---|

| Q1 2024 17 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 17 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 18 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 19 Jul 2023 | Q2 2023 Earnings Call Transcript |

U.S. Bancorp: Attractive As It Solves Its Capital Weakness

PNC Financial: Long-Term Investors Should Wait For A Pullback

US Bancorp: Improving Fundamentals With Reasonable Valuations

U.S. Bancorp: Buy The Drop And Lock In A 5% Yield (Rating Upgrade)

Some Names I've Bought During Tariff Mayhem

Stock Picks From Seeking Alpha's March 2025 New Analysts

PNC Looks Good Now, And Loan Growth Reacceleration Would Make It Even Better

Citigroup: Progress Made, But Much Is Still To Be Done

U.S. Bancorp: Strong Return On Equity Should Lead To Sector Outperformance

-

What's the price of U.S. Bancorp stock today?

One share of U.S. Bancorp stock can currently be purchased for approximately $46.27.

-

When is U.S. Bancorp's next earnings date?

U.S. Bancorp is estimated to report earnings on Thursday, 16 Oct 2025.

-

Does U.S. Bancorp pay dividends?

Yes, U.S. Bancorp pays dividends and its trailing 12-month yield is 3.05% with 62% payout ratio. The last U.S. Bancorp stock dividend of $0.46 was paid on 18 Jan 2022.

-

How much money does U.S. Bancorp make?

U.S. Bancorp has a market capitalization of 74.57B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 15.83% to 28.01B US dollars. U.S. Bancorp earned 5.43B US dollars in net income (profit) last year or $1.03 on an earnings per share basis.

-

What is U.S. Bancorp's stock symbol?

U.S. Bancorp is traded on the NYSE under the ticker symbol "USB".

-

What is U.S. Bancorp's primary industry?

Company operates in the Financial Services sector and Banks - Regional industry.

-

How do i buy shares of U.S. Bancorp?

Shares of U.S. Bancorp can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are U.S. Bancorp's key executives?

U.S. Bancorp's management team includes the following people:

- Mr. Andrew J. Cecere Chairman, Pres & Chief Executive Officer(age: 64, pay: $3,210,000)

- Mr. Timothy A. Welsh Vice Chairman of Consumer & Bus. Banking(age: 59, pay: $1,610,000)

- Mr. Terrance R. Dolan Vice Chairman & Chief Financial Officer(age: 63, pay: $1,550,000)

- Ms. Gunjan Kedia Vice Chairman of Wealth Management & Investment Services(age: 54, pay: $1,510,000)

- Mr. Jeffry H. von Gillern Vice Chairman of Technology & Operations Services(age: 59, pay: $1,370,000)

-

How many employees does U.S. Bancorp have?

As Jul 2024, U.S. Bancorp employs 70,000 workers, which is 7% less then previous quarter.

-

When U.S. Bancorp went public?

U.S. Bancorp is publicly traded company for more then 52 years since IPO on 3 May 1973.

-

What is U.S. Bancorp's official website?

The official website for U.S. Bancorp is usbank.com.

-

Where are U.S. Bancorp's headquarters?

U.S. Bancorp is headquartered at 800 Nicollet Mall, Minneapolis, MN.

-

How can i contact U.S. Bancorp?

U.S. Bancorp's mailing address is 800 Nicollet Mall, Minneapolis, MN and company can be reached via phone at +65 14663000.

-

What is U.S. Bancorp stock forecast & price target?

Based on 12 Wall Street analysts` predicted price targets for U.S. Bancorp in the last 12 months, the avarage price target is $53.5. The average price target represents a 15.62% change from the last price of $46.27.

U.S. Bancorp company profile:

U.S. Bancorp

usbank.comNYSE

70,000

Banks - Regional

Financial Services

U.S. Bancorp, a financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities and other financial institutions in the United States. It operates in Corporate and Commercial Banking, Consumer and Business Banking, Wealth Management and Investment Services, Payment Services, and Treasury and Corporate Support segments. The company offers depository services, including checking accounts, savings accounts, and time certificate contracts; lending services, such as traditional credit products; and credit card services, lease financing and import/export trade, asset-backed lending, agricultural finance, and other products. It also provides ancillary services comprising capital markets, treasury management, and receivable lock-box collection services to corporate and governmental entity customers; and a range of asset management and fiduciary services for individuals, estates, foundations, business corporations, and charitable organizations. In addition, the company offers investment and insurance products to its customers principally within its markets, as well as fund administration services to a range of mutual and other funds. Further, it provides corporate and purchasing card, and corporate trust services; and merchant processing services, as well as investment management, ATM processing, mortgage banking, insurance, and brokerage and leasing services. As of December 31, 2021, the company provided its products and services through a network of 2,230 banking offices principally operating in the Midwest and West regions of the United States, as well as through on-line services, over mobile devices, and other distribution channels; and operated a network of 4,059 ATMs. The company was founded in 1863 and is headquartered in Minneapolis, Minnesota.

Minneapolis, MN 55402

CIK: 0000036104

ISIN: US9029733048

CUSIP: 902973304