MicroSectors U.S. Big Oil Index Inverse ETNs – AMEX:YGRN

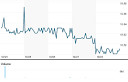

MicroSectors U.S. Big Oil Index Inverse ETNs stock price today

MicroSectors U.S. Big Oil Index Inverse ETNs key metrics

Market Cap | 32.52M |

Enterprise value | N/A |

P/E | N/A |

EV/Sales | N/A |

EV/EBITDA | N/A |

Price/Sales | N/A |

Price/Book | N/A |

PEG ratio | N/A |

EPS | N/A |

Revenue | N/A |

EBITDA | N/A |

Income | N/A |

Revenue Q/Q | N/A |

Revenue Y/Y | N/A |

Profit margin | 0% |

Oper. margin | 0% |

Gross margin | 0% |

EBIT margin | 0% |

EBITDA margin | N/A |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeMicroSectors U.S. Big Oil Index Inverse ETNs stock price history

MicroSectors U.S. Big Oil Index Inverse ETNs stock forecast

MicroSectors U.S. Big Oil Index Inverse ETNs financial statements

MicroSectors U.S. Big Oil Index Inverse ETNs other data

-

What's the price of MicroSectors U.S. Big Oil Index Inverse ETNs stock today?

One share of MicroSectors U.S. Big Oil Index Inverse ETNs stock can currently be purchased for approximately $40.03.

-

When is MicroSectors U.S. Big Oil Index Inverse ETNs's next earnings date?

Unfortunately, MicroSectors U.S. Big Oil Index Inverse ETNs's (YGRN) next earnings date is currently unknown.

-

Does MicroSectors U.S. Big Oil Index Inverse ETNs pay dividends?

No, MicroSectors U.S. Big Oil Index Inverse ETNs does not pay dividends.

-

How much money does MicroSectors U.S. Big Oil Index Inverse ETNs make?

MicroSectors U.S. Big Oil Index Inverse ETNs has a market capitalization of 32.52M.

-

What is MicroSectors U.S. Big Oil Index Inverse ETNs's stock symbol?

MicroSectors U.S. Big Oil Index Inverse ETNs is traded on the AMEX under the ticker symbol "YGRN".

-

What is MicroSectors U.S. Big Oil Index Inverse ETNs's primary industry?

Company operates in the Financial Services sector and Asset Management - Leveraged industry.

-

How do i buy shares of MicroSectors U.S. Big Oil Index Inverse ETNs?

Shares of MicroSectors U.S. Big Oil Index Inverse ETNs can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

When MicroSectors U.S. Big Oil Index Inverse ETNs went public?

MicroSectors U.S. Big Oil Index Inverse ETNs is publicly traded company for more then 6 years since IPO on 9 Apr 2019.

-

How can i contact MicroSectors U.S. Big Oil Index Inverse ETNs?

MicroSectors U.S. Big Oil Index Inverse ETNs can be reached via phone at +20 3 5576201.

MicroSectors U.S. Big Oil Index Inverse ETNs company profile:

AMEX

0

Asset Management - Leveraged

Financial Services

The investment seeks to reflect an inverse exposure to the performance of the Solactive MicroSectorsTM U.S. Big Oil Index on a daily basis. The notes are senior unsecured medium-term notes issued by Bank of Montreal with a return linked to the inverse performance of the index, compounded daily, less a Daily Investor Fee, any negative Daily Interest and, if applicable, the Redemption Fee Amount. The index is an equal-dollar weighted index designed to represent the 10 U.S. listed stocks with the largest market capitalization in the energy/oil sector.

:

:

: