Next earnings date: 16 Oct 2025

Ally Financial Inc. – NYSE:ALLY

Ally Financial stock price today

Ally Financial stock price monthly change

Ally Financial stock price quarterly change

Ally Financial stock price yearly change

Ally Financial key metrics

Market Cap | 10.59B |

Enterprise value | 20.55B |

P/E | 12.39 |

EV/Sales | 1.60 |

EV/EBITDA | 10.49 |

Price/Sales | 0.85 |

Price/Book | 0.74 |

PEG ratio | -0.72 |

EPS | 2.54 |

Revenue | 9.92B |

EBITDA | 1.07B |

Income | 858M |

Revenue Q/Q | 118.72% |

Revenue Y/Y | 24.98% |

Profit margin | 6.92% |

Oper. margin | 6.64% |

Gross margin | 73.45% |

EBIT margin | 6.64% |

EBITDA margin | 10.79% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeAlly Financial stock price history

Ally Financial stock forecast

Ally Financial financial statements

$40.88

Potential upside: 7.53%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 1.85B | 329M | 17.76% |

|---|---|---|---|

| Sep 2023 | 1.67B | 296M | 17.7% |

| Dec 2023 | 2.29B | 76M | 3.32% |

| Mar 2024 | 4.11B | 157M | 3.82% |

| 2024-10-18 | 0.53 | 0.95 |

|---|

| Payout ratio | 54.41% |

|---|

| 2019 | 2.27% |

|---|---|

| 2020 | 2.16% |

| 2021 | 2.21% |

| 2022 | 6.38% |

| 2023 | 4.51% |

| Jun 2023 | 197241000000 | 183.70B | 93.14% |

|---|---|---|---|

| Sep 2023 | 195704000000 | 182.87B | 93.45% |

| Dec 2023 | 196392000000 | 182.62B | 92.99% |

| Mar 2024 | 192877000000 | 179.22B | 92.92% |

| Jun 2023 | 1.58B | -2.09B | 550M |

|---|---|---|---|

| Sep 2023 | 1.66B | -1.73B | -1.44B |

| Dec 2023 | -17M | -3.07B | 1.40B |

| Mar 2024 | 1.34B | 3.50B | -3.63B |

Ally Financial alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

Online Lending Companies

| Aug 2023 | 0.314 | 0.209 | 0.127 | 0.091 | 0.066 | 0.056 | 0.052 | 0.042 | 0.025 | 0.010 | 0.003 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Sep 2023 | 0.307 | 0.213 | 0.132 | 0.088 | 0.060 | 0.057 | 0.054 | 0.043 | 0.026 | 0.012 | 0.002 |

| Oct 2023 | 0.311 | 0.209 | 0.129 | 0.097 | 0.061 | 0.056 | 0.051 | 0.042 | 0.025 | 0.012 | 0.002 |

| Nov 2023 | 0.301 | 0.229 | 0.116 | 0.098 | 0.062 | 0.050 | 0.056 | 0.038 | 0.032 | 0.011 | 0.002 |

| Dec 2023 | 0.313 | 0.195 | 0.121 | 0.101 | 0.069 | 0.052 | 0.058 | 0.040 | 0.033 | 0.009 | 0.002 |

| Jan 2024 | 0.320 | 0.231 | 0.135 | 0.072 | 0.056 | 0.051 | 0.045 | 0.039 | 0.032 | 0.011 | 0.003 |

| Feb 2024 | 0.337 | 0.213 | 0.133 | 0.081 | 0.057 | 0.047 | 0.041 | 0.043 | 0.030 | 0.010 | 0.002 |

| Mar 2024 | 0.333 | 0.210 | 0.131 | 0.080 | 0.062 | 0.046 | 0.040 | 0.046 | 0.034 | 0.010 | 0.002 |

| Apr 2024 | 0.328 | 0.213 | 0.132 | 0.075 | 0.065 | 0.047 | 0.041 | 0.046 | 0.036 | 0.010 | 0.002 |

| May 2024 | 0.278 | 0.212 | 0.134 | 0.089 | 0.090 | 0.046 | 0.050 | 0.047 | 0.036 | 0.010 | 0.002 |

| Jun 2024 | 0.223 | 0.216 | 0.133 | 0.127 | 0.134 | 0.039 | 0.043 | 0.043 | 0.028 | 0.007 | 0.002 |

| Jul 2024 | 0.229 | 0.222 | 0.136 | 0.115 | 0.094 | 0.049 | 0.061 | 0.045 | 0.033 | 0.009 | 0.002 |

| Aug 2024 | 0.262 | 0.215 | 0.150 | 0.083 | 0.068 | 0.047 | 0.071 | 0.048 | 0.037 | 0.011 | 0.002 |

| Sep 2024 | 0.236 | 0.194 | 0.207 | 0.081 | 0.070 | 0.042 | 0.047 | 0.073 | 0.031 | 0.011 | 0.002 |

| Oct 2024 | 0.234 | 0.192 | 0.211 | 0.088 | 0.072 | 0.042 | 0.046 | 0.064 | 0.035 | 0.011 | 0.002 |

| Nov 2024 | 0.246 | 0.219 | 0.149 | 0.118 | 0.077 | 0.039 | 0.052 | 0.050 | 0.032 | 0.011 | 0.002 |

| Dec 2024 | 0.253 | 0.208 | 0.158 | 0.126 | 0.069 | 0.037 | 0.061 | 0.040 | 0.031 | 0.010 | 0.002 |

| Jan 2025 | 0.281 | 0.199 | 0.180 | 0.081 | 0.063 | 0.042 | 0.057 | 0.044 | 0.033 | 0.011 | 0.003 |

| Feb 2025 | 0.283 | 0.192 | 0.172 | 0.089 | 0.068 | 0.042 | 0.054 | 0.047 | 0.032 | 0.013 | 0.003 |

| Mar 2025 | 0.286 | 0.209 | 0.157 | 0.086 | 0.061 | 0.045 | 0.049 | 0.055 | 0.031 | 0.014 | 0.002 |

| Apr 2025 | 0.279 | 0.204 | 0.156 | 0.094 | 0.060 | 0.044 | 0.057 | 0.054 | 0.030 | 0.014 | 0.002 |

| May 2025 | 0.247 | 0.238 | 0.152 | 0.100 | 0.058 | 0.043 | 0.056 | 0.053 | 0.033 | 0.014 | 0.001 |

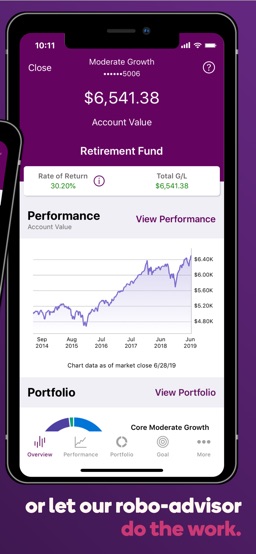

Ally: Banking & Investing

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 63 |

|---|---|

| Sep 2023 | 55 |

| Oct 2023 | 68 |

| Nov 2023 | 80 |

| Dec 2023 | 90 |

| Jan 2024 | 44 |

| Feb 2024 | 21 |

| Mar 2024 | 62 |

| Apr 2024 | 49 |

| May 2024 | 79 |

Ally: Banking & Investing

| Platform: | iOS |

| Store: | App Store |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 55 |

|---|---|

| Sep 2023 | 45 |

| Oct 2023 | 57 |

| Nov 2023 | 72 |

| Dec 2023 | 67 |

| Jan 2024 | 20 |

| Feb 2024 | 10 |

| Mar 2024 | 38 |

| Apr 2024 | 26 |

| May 2024 | 34 |

| Jun 2024 | 41 |

Ally Financial Social Media Accounts

| May 2025 | 67199 |

|---|---|

| Jul 2025 | 73171 |

| Aug 2025 | 81195 |

Ally Financial

| 12 Feb 2023 | 3 | 61 |

|---|---|---|

| 19 Feb 2023 | 3 | 67 |

| 26 Feb 2023 | 3 | 61 |

| 5 Mar 2023 | 3 | 61 |

| 12 Mar 2023 | 3 | 60 |

| 19 Mar 2023 | 3 | 59 |

| 26 Mar 2023 | 3 | 58 |

| 2 Apr 2023 | 3 | 55 |

| 9 Apr 2023 | 3 | 52 |

| 16 Apr 2023 | 3 | 55 |

| 23 Apr 2023 | 3 | 49 |

| 30 Apr 2023 | 3 | 57 |

| 7 May 2023 | 3 | 56 |

| 14 May 2023 | 2 | 56 |

| 21 May 2023 | 3 | 60 |

| 28 May 2023 | 3 | 58 |

| 4 Jun 2023 | 3 | 58 |

| 11 Jun 2023 | 3 | 55 |

| 18 Jun 2023 | 3 | 67 |

| 25 Jun 2023 | 3 | 64 |

Ally Insurance

| 26 Feb 2023 | 43 |

|---|---|

| 5 Mar 2023 | 64 |

| 12 Mar 2023 | 59 |

| 19 Mar 2023 | 67 |

| 26 Mar 2023 | 55 |

| 2 Apr 2023 | 54 |

| 9 Apr 2023 | 67 |

| 16 Apr 2023 | 63 |

| 23 Apr 2023 | 49 |

| 30 Apr 2023 | 46 |

| 7 May 2023 | 32 |

| 14 May 2023 | 37 |

| 21 May 2023 | 69 |

| 28 May 2023 | 41 |

| 4 Jun 2023 | 53 |

| 11 Jun 2023 | 33 |

| 18 Jun 2023 | 30 |

| 25 Jun 2023 | 27 |

| 2 Jul 2023 | 70 |

| 9 Jul 2023 | 39 |

Ally Products & Services

| 4 Aug 2024 | 3 | 46 | 2 | 0 | 6 |

|---|---|---|---|---|---|

| 11 Aug 2024 | 3 | 45 | 3 | 0 | 5 |

| 18 Aug 2024 | 3 | 42 | 2 | 0 | 6 |

| 25 Aug 2024 | 3 | 44 | 2 | 0 | 5 |

| 1 Sep 2024 | 3 | 42 | 2 | 0 | 5 |

| 8 Sep 2024 | 3 | 41 | 2 | 0 | 5 |

| 15 Sep 2024 | 3 | 42 | 2 | 0 | 5 |

| 22 Sep 2024 | 3 | 40 | 2 | 0 | 5 |

| 29 Sep 2024 | 3 | 38 | 2 | 0 | 5 |

| 6 Oct 2024 | 3 | 36 | 2 | 0 | 5 |

| 13 Oct 2024 | 3 | 35 | 2 | 0 | 5 |

| 20 Oct 2024 | 3 | 38 | 2 | 0 | 5 |

| 27 Oct 2024 | 3 | 36 | 2 | 0 | 5 |

| 3 Nov 2024 | 3 | 31 | 2 | 0 | 5 |

| 10 Nov 2024 | 3 | 38 | 2 | 0 | 5 |

| 17 Nov 2024 | 3 | 37 | 2 | 0 | 5 |

| 24 Nov 2024 | 3 | 34 | 2 | 0 | 5 |

| 1 Dec 2024 | 3 | 29 | 1 | 0 | 5 |

| 8 Dec 2024 | 3 | 36 | 2 | 0 | 5 |

| 15 Dec 2024 | 3 | 41 | 2 | 0 | 5 |

Online Lending Companies

| 12 Feb 2023 | 0 | 0 | 16 | 49 | 3 |

|---|---|---|---|---|---|

| 19 Feb 2023 | 0 | 0 | 15 | 51 | 2 |

| 26 Feb 2023 | 0 | 0 | 19 | 48 | 2 |

| 5 Mar 2023 | 0 | 0 | 37 | 47 | 2 |

| 12 Mar 2023 | 0 | 0 | 21 | 48 | 3 |

| 19 Mar 2023 | 0 | 0 | 14 | 46 | 2 |

| 26 Mar 2023 | 0 | 0 | 14 | 47 | 2 |

| 2 Apr 2023 | 0 | 0 | 13 | 44 | 2 |

| 9 Apr 2023 | 0 | 0 | 13 | 43 | 2 |

| 16 Apr 2023 | 0 | 0 | 17 | 44 | 2 |

| 23 Apr 2023 | 0 | 0 | 12 | 40 | 2 |

| 30 Apr 2023 | 0 | 3 | 13 | 47 | 2 |

| 7 May 2023 | 0 | 0 | 14 | 45 | 2 |

| 14 May 2023 | 0 | 0 | 13 | 45 | 2 |

| 21 May 2023 | 0 | 0 | 13 | 47 | 3 |

| 28 May 2023 | 0 | 0 | 15 | 47 | 3 |

| 4 Jun 2023 | 0 | 0 | 15 | 47 | 4 |

| 11 Jun 2023 | 0 | 0 | 15 | 44 | 5 |

| 18 Jun 2023 | 0 | 0 | 14 | 53 | 3 |

| 25 Jun 2023 | 0 | 0 | 20 | 53 | 3 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 91 |

|---|---|

| Oct 2023 | 74 |

| Nov 2023 | 76 |

| Dec 2023 | 94 |

| Jan 2024 | 89 |

| Feb 2024 | 88 |

| Apr 2024 | 95 |

| May 2024 | 79 |

| Jun 2024 | 65 |

| Jul 2024 | 83 |

| Sep 2023 | 11,600 |

|---|---|

| Oct 2023 | 11,600 |

| Nov 2023 | 11,600 |

| Dec 2023 | 11,600 |

| Jan 2024 | 11,600 |

| Feb 2024 | 11,600 |

| Mar 2024 | 11,100 |

| Apr 2024 | 11,100 |

| May 2024 | 11,100 |

| Jun 2024 | 11,100 |

| Jul 2024 | 11,100 |

Ally Financial other data

| Period | Buy | Sel |

|---|---|---|

| Dec 2023 | 0 | 15000 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Sale | DEBRUNNER DAVID J officer: VP, CAO,.. | Common Stock | 3,750 | $35 | $131,250 | ||

Sale | DEBRUNNER DAVID J officer: VP, CAO,.. | Common Stock | 3,750 | $35 | $131,250 | ||

Sale | DEBRUNNER DAVID J officer: VP, CAO,.. | Common Stock | 3,750 | $33.6 | $126,000 | ||

Sale | DEBRUNNER DAVID J officer: VP, CAO,.. | Common Stock | 3,750 | $34 | $127,500 | ||

Purchase | MAGNER MARJORIE director | Common Stock | 2,000 | $27.43 | $54,868 | ||

Sale | SCHUGEL JASON E. officer: Chief Risk Officer | Common Stock | 2,500 | $45 | $112,500 | ||

Sale | SCHUGEL JASON E. officer: Chief Risk Officer | Common Stock | 2,500 | $49.21 | $123,025 | ||

Sale | TIMMERMAN DOUGLAS R. officer: Presiden.. | Common Stock | 2,916 | $49.21 | $143,496 | ||

Sale | TIMMERMAN DOUGLAS R. officer: Presiden.. | Common Stock | 2,916 | $49.21 | $143,496 | ||

Sale | TIMMERMAN DOUGLAS R. officer: Presiden.. | Common Stock | 2,916 | $47.78 | $139,326 |

| Quarter | Transcript |

|---|---|

| Q1 2024 18 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 19 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 18 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 19 Jul 2023 | Q2 2023 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

| Mr. Jeffrey J. Brown (1973) Chief Executive Officer & Director | $4,720,000 |

| Mr. Douglas R. Timmerman (1963) Pres of Dealer Financial Services | $1,930,000 |

| Ms. Diane E. Morais (1966) Pres of Consumer & Commercial Banking - Ally Bank | $1,880,000 |

| Ms. Jennifer A. LaClair (1972) Chief Financial Officer | $1,790,000 |

| Mr. Scott A. Stengel (1972) Gen. Counsel | $1,270,000 |

Ally Financial Upgraded As Digital-First Banking Shows Further Upside Potential

Ally Financial: Shares Look Cheap On Easing Cyclical Headwinds

SoFi Technologies: Extremely Expensive At 50x P/E But Growth Opportunities Justify Premium

Ally Financial: Rise In Used Car Prices Could Help Mitigate Credit Risk (Rating Upgrade)

MoneyShow's Best Investment Ideas For 2025: Part 6

Household Financial Distress Is Rising - Short Ally Financial

Credit Acceptance: There Are Better Opportunities

Ally Financial: Driving Forward With A Strong Moat In A High-Yield Environment

Ally Financial's Discount To Tangible Book Makes Little Sense

-

What's the price of Ally Financial stock today?

One share of Ally Financial stock can currently be purchased for approximately $38.01.

-

When is Ally Financial's next earnings date?

Ally Financial Inc. is estimated to report earnings on Thursday, 16 Oct 2025.

-

Does Ally Financial pay dividends?

Yes, Ally Financial pays dividends and its trailing 12-month yield is 3.37% with 54% payout ratio. The last Ally Financial stock dividend of $0.3 was paid on 15 Feb 2022.

-

How much money does Ally Financial make?

Ally Financial has a market capitalization of 10.59B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 14.19% to 9.07B US dollars. Ally Financial earned 1.02B US dollars in net income (profit) last year or $0.95 on an earnings per share basis.

-

What is Ally Financial's stock symbol?

Ally Financial Inc. is traded on the NYSE under the ticker symbol "ALLY".

-

What is Ally Financial's primary industry?

Company operates in the Financial Services sector and Financial - Credit Services industry.

-

How do i buy shares of Ally Financial?

Shares of Ally Financial can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are Ally Financial's key executives?

Ally Financial's management team includes the following people:

- Mr. Jeffrey J. Brown Chief Executive Officer & Director(age: 52, pay: $4,720,000)

- Mr. Douglas R. Timmerman Pres of Dealer Financial Services(age: 62, pay: $1,930,000)

- Ms. Diane E. Morais Pres of Consumer & Commercial Banking - Ally Bank(age: 59, pay: $1,880,000)

- Ms. Jennifer A. LaClair Chief Financial Officer(age: 53, pay: $1,790,000)

- Mr. Scott A. Stengel Gen. Counsel(age: 53, pay: $1,270,000)

-

How many employees does Ally Financial have?

As Jul 2024, Ally Financial employs 11,100 workers.

-

When Ally Financial went public?

Ally Financial Inc. is publicly traded company for more then 11 years since IPO on 28 Jan 2014.

-

What is Ally Financial's official website?

The official website for Ally Financial is ally.com.

-

Where are Ally Financial's headquarters?

Ally Financial is headquartered at Ally Detroit Center, Detroit, MI.

-

How can i contact Ally Financial?

Ally Financial's mailing address is Ally Detroit Center, Detroit, MI and company can be reached via phone at +86 67104623.

-

What is Ally Financial stock forecast & price target?

Based on 7 Wall Street analysts` predicted price targets for Ally Financial in the last 12 months, the avarage price target is $40.88. The average price target represents a 7.53% change from the last price of $38.01.

Ally Financial company profile:

Ally Financial Inc.

ally.comNYSE

11,100

Financial - Credit Services

Financial Services

Ally Financial Inc., a digital financial-services company, provides various digital financial products and services to consumer, commercial, and corporate customers primarily in the United States and Canada. It operates through four segments: Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations. The Automotive Finance Operations segment offers automotive financing services, including providing retail installment sales contracts, loans and operating leases, term loans to dealers, financing dealer floorplans and other lines of credit to dealers, warehouse lines to automotive retailers, and fleet financing. It also provides financing services to companies and municipalities for the purchase or lease of vehicles, and vehicle-remarketing services. The Insurance Operations segment offers consumer finance protection and insurance products through the automotive dealer channel, and commercial insurance products directly to dealers. This segment provides vehicle service and maintenance contract, and guaranteed asset protection products; and underwrites commercial insurance coverages, which primarily insure dealers' vehicle inventory. The Mortgage Finance Operations segment manages consumer mortgage loan portfolio that includes bulk purchases of jumbo and low-to-moderate income mortgage loans originated by third parties, as well as direct-to-consumer mortgage offerings. The Corporate Finance Operations segment provides senior secured leveraged cash flow and asset-based loans to middle market companies; leveraged loans; and commercial real estate product to serve companies in the healthcare industry. The company also offers commercial banking products and services. In addition, it provides securities brokerage and investment advisory services. The company was formerly known as GMAC Inc. and changed its name to Ally Financial Inc. in May 2010. Ally Financial Inc. was founded in 1919 and is based in Detroit, Michigan.

Detroit, MI 48226

CIK: 0000040729

ISIN: US02005N1000

CUSIP: 02005N100