Next earnings date: 15 Oct 2025

Bank of America Corporation – NYSE:BAC

Bank of America stock price today

Bank of America stock price monthly change

Bank of America stock price quarterly change

Bank of America stock price yearly change

Bank of America key metrics

Market Cap | 336.45B |

Enterprise value | 380.25B |

P/E | 14.68 |

EV/Sales | 4.01 |

EV/EBITDA | 102.05 |

Price/Sales | 3.59 |

Price/Book | 1.16 |

PEG ratio | 6.85 |

EPS | 2.92 |

Revenue | 94.67B |

EBITDA | 28.58B |

Income | 25.02B |

Revenue Q/Q | 1.93% |

Revenue Y/Y | 0.15% |

Profit margin | 24.95% |

Oper. margin | 38.63% |

Gross margin | 11.82% |

EBIT margin | 38.63% |

EBITDA margin | 30.19% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeBank of America stock price history

Bank of America stock forecast

Bank of America financial statements

$46.4

Potential downside: -3.66%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 24.07B | 7.40B | 30.77% |

|---|---|---|---|

| Sep 2023 | 23.93B | 7.80B | 32.6% |

| Dec 2023 | 20.85B | 3.14B | 15.08% |

| Mar 2024 | 25.81B | 6.67B | 25.85% |

| 2024-10-15 | 0.77 | 0.81 |

|---|

| Payout ratio | 40.07% |

|---|

| 2019 | 1.79% |

|---|---|

| 2020 | 2.91% |

| 2021 | 2.13% |

| 2022 | 3.19% |

| 2023 | 3.36% |

| Jun 2023 | 3122633000000 | 2.83T | 90.93% |

|---|---|---|---|

| Sep 2023 | 3153090000000 | 2.86T | 90.9% |

| Dec 2023 | 3180151000000 | 2.88T | 90.83% |

| Mar 2024 | 3273803000000 | 2.98T | 91.03% |

| Jun 2023 | 11.78B | 57.88B | -71.69B |

|---|---|---|---|

| Sep 2023 | 11.77B | -59.93B | 27.62B |

| Dec 2023 | 32.72B | -64.18B | 11.29B |

| Mar 2024 | -15.53B | -71.32B | 68.65B |

Bank of America alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

Bank of America Competitors

| Aug 2023 | 0.491 | 0.401 | 0.099 | 0.007 |

|---|---|---|---|---|

| Sep 2023 | 0.491 | 0.400 | 0.098 | 0.009 |

| Oct 2023 | 0.491 | 0.401 | 0.099 | 0.007 |

| Nov 2023 | 0.478 | 0.394 | 0.118 | 0.008 |

| Dec 2023 | 0.526 | 0.353 | 0.106 | 0.013 |

| Jan 2024 | 0.490 | 0.400 | 0.098 | 0.011 |

| Feb 2024 | 0.440 | 0.440 | 0.108 | 0.009 |

| Mar 2024 | 0.491 | 0.400 | 0.098 | 0.009 |

| Apr 2024 | 0.491 | 0.400 | 0.098 | 0.009 |

| May 2024 | 0.491 | 0.400 | 0.098 | 0.009 |

| Jun 2024 | 0.489 | 0.399 | 0.098 | 0.013 |

| Jul 2024 | 0.488 | 0.398 | 0.098 | 0.014 |

| Aug 2024 | 0.487 | 0.397 | 0.098 | 0.016 |

| Sep 2024 | 0.437 | 0.437 | 0.108 | 0.016 |

| Oct 2024 | 0.489 | 0.399 | 0.098 | 0.013 |

| Nov 2024 | 0.438 | 0.438 | 0.108 | 0.014 |

| Dec 2024 | 0.485 | 0.396 | 0.097 | 0.020 |

| Jan 2025 | 0.485 | 0.396 | 0.097 | 0.019 |

| Feb 2025 | 0.486 | 0.397 | 0.098 | 0.018 |

| Mar 2025 | 0.487 | 0.397 | 0.098 | 0.016 |

| Apr 2025 | 0.486 | 0.397 | 0.098 | 0.017 |

| May 2025 | 0.485 | 0.396 | 0.097 | 0.020 |

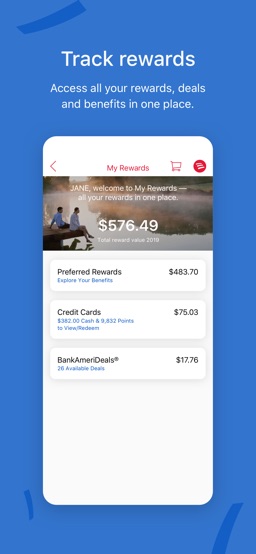

Bank of America Mobile Banking

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 9 |

|---|---|

| Sep 2023 | 11 |

| Oct 2023 | 12 |

| Nov 2023 | 13 |

| Dec 2023 | 11 |

| Jan 2024 | 13 |

| Feb 2024 | 17 |

| Mar 2024 | 14 |

| Apr 2024 | 16 |

| May 2024 | 18 |

| Jun 2024 | 13 |

| Jul 2024 | 17 |

| Aug 2024 | 13 |

| Sep 2024 | 14 |

| Oct 2024 | 14 |

| Nov 2024 | 17 |

| Dec 2024 | 19 |

Bank of America Mobile Banking

| Platform: | iOS |

| Store: | App Store |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 176 |

|---|---|

| Sep 2023 | 153 |

| Oct 2023 | 168 |

| Nov 2023 | 165 |

| Dec 2023 | 204 |

| Jan 2024 | 158 |

| Feb 2024 | 152 |

| Mar 2024 | 204 |

| Apr 2024 | 166 |

| May 2024 | 168 |

| Jun 2024 | 191 |

| Jul 2024 | 171 |

| Aug 2024 | 164 |

| Sep 2024 | 255 |

| Oct 2024 | 181 |

| Nov 2024 | 229 |

| Dec 2024 | 217 |

Bank of America Social Media Accounts

| May 2025 | 302750 |

|---|---|

| Jul 2025 | 305586 |

| Aug 2025 | 308702 |

Competitors

| 12 Feb 2023 | 3 | 14 | 53 | 42 |

|---|---|---|---|---|

| 19 Feb 2023 | 3 | 14 | 52 | 42 |

| 26 Feb 2023 | 3 | 16 | 52 | 47 |

| 5 Mar 2023 | 4 | 14 | 50 | 42 |

| 12 Mar 2023 | 3 | 14 | 50 | 45 |

| 19 Mar 2023 | 4 | 13 | 47 | 40 |

| 26 Mar 2023 | 3 | 15 | 50 | 44 |

| 2 Apr 2023 | 3 | 13 | 49 | 40 |

| 9 Apr 2023 | 3 | 13 | 48 | 40 |

| 16 Apr 2023 | 3 | 12 | 45 | 37 |

| 23 Apr 2023 | 3 | 13 | 48 | 37 |

| 30 Apr 2023 | 3 | 13 | 45 | 35 |

| 7 May 2023 | 3 | 13 | 48 | 37 |

| 14 May 2023 | 3 | 13 | 47 | 35 |

| 21 May 2023 | 3 | 12 | 42 | 32 |

| 28 May 2023 | 3 | 14 | 51 | 39 |

| 4 Jun 2023 | 3 | 13 | 46 | 38 |

| 11 Jun 2023 | 3 | 12 | 48 | 38 |

| 18 Jun 2023 | 2 | 12 | 46 | 35 |

| 25 Jun 2023 | 3 | 14 | 64 | 45 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 2,067 |

|---|---|

| Oct 2023 | 2,287 |

| Nov 2023 | 2,375 |

| Dec 2023 | 1,996 |

| Jan 2024 | 2,004 |

| Feb 2024 | 2,272 |

| Apr 2024 | 2,537 |

| May 2024 | 2,899 |

| Jan 2025 | 3,050 |

| Feb 2025 | 2,881 |

| May 2025 | 3,592 |

| Jul 2025 | 3,989 |

| Aug 2025 | 3,755 |

| Sep 2023 | 216,000 |

|---|---|

| Oct 2023 | 216,000 |

| Nov 2023 | 212,752 |

| Dec 2023 | 213,000 |

| Jan 2024 | 213,000 |

| Feb 2024 | 212,985 |

| Mar 2024 | 213,000 |

| Apr 2024 | 213,000 |

| May 2024 | 212,335 |

| Jun 2024 | 212,000 |

| Jul 2024 | 212,000 |

Bank of America other data

| Period | Buy | Sel |

|---|---|---|

| Jul 2024 | 0 | 31983756 |

| Aug 2024 | 0 | 65456803 |

| Sep 2024 | 0 | 85040596 |

| Oct 2024 | 0 | 31377845 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | MOYNIHAN BRIAN T director, officer.. | Common Stock | 20,683 | N/A | N/A | ||

Option | MOYNIHAN BRIAN T director, officer.. | 2024 Cash Settled Restricted Stock Units | 20,683 | N/A | N/A | ||

Option | SCHIMPF ERIC A. officer: Pres, Merrill Wealth M.. | Common Stock | 1,234 | N/A | N/A | ||

Option | SCHIMPF ERIC A. officer: Pres, Merrill Wealth M.. | Restricted Stock Units | 1,234 | N/A | N/A | ||

Option | HANS LINDSAY D. officer: Pres, Merrill Wealth M.. | Common Stock | 975 | N/A | N/A | ||

Option | HANS LINDSAY D. officer: Pres, Merrill Wealth M.. | Restricted Stock Units | 975 | N/A | N/A | ||

Option | BLESS RUDOLF A. officer: Chief Accounting Officer | Common Stock | 2,674 | N/A | N/A | ||

Option | BLESS RUDOLF A. officer: Chief Accounting Officer | Restricted Stock Units | 2,674 | N/A | N/A | ||

Option | MOYNIHAN BRIAN T director, officer.. | Common Stock | 20,683 | N/A | N/A | ||

Option | MOYNIHAN BRIAN T director, officer.. | 2024 Cash Settled Restricted Stock Units | 20,683 | N/A | N/A |

| Patent |

|---|

Grant Filling date: 9 Jun 2021 Issue date: 20 Sep 2022 |

Grant Filling date: 15 Apr 2021 Issue date: 20 Sep 2022 |

Grant Utility: Dynamic profile control system Filling date: 1 Dec 2020 Issue date: 20 Sep 2022 |

Grant Utility: System for establishment and dynamic adjustment of control parameters associated with resource distribution Filling date: 24 Jul 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 25 Jun 2020 Issue date: 20 Sep 2022 |

Grant Utility: Augmented reality (AR)-assisted smart card for secure and accurate revision and/or submission of sensitive documents Filling date: 9 Jun 2020 Issue date: 20 Sep 2022 |

Grant Utility: System and method for monitoring computing platform parameters and dynamically generating and deploying monitoring packages Filling date: 28 May 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 19 May 2020 Issue date: 20 Sep 2022 |

Grant Utility: System for automated electronic data exfiltration path identification, prioritization, and remediation Filling date: 23 Apr 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 27 Aug 2019 Issue date: 20 Sep 2022 |

| Quarter | Transcript |

|---|---|

| Q1 2024 16 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 12 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 17 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 18 Jul 2023 | Q2 2023 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

| Mr. Geoffrey S. Greener (1965) Chief Risk Officer | $5,440,000 |

| Mr. Paul M. Donofrio (1960) Vice Chairman | $5,440,000 |

| Mr. Dean C. Athanasia (1967) Pres of Regional Banking | $5,280,000 |

| Mr. Brian Thomas Moynihan (1959) Chairman, Chief Executive Officer & Pres | $1,740,000 |

Blue Ridge Bankshares: Discounted Valuation Is Justified By Fundamental Issues

Bank of America: A Mispriced Capital Return Engine

Citigroup: It Is Not Too Late To Invest

Bank of America: A Top Bank Buy For 2025

Bank of America: CPI Report, Robust Q2 Earnings, Moderate Valuation

Tariffs Reignited: Best Stocks To Buy Now

These Are The Most Overvalued And Undervalued Mega Cap Stocks

Bank of America: Structural Compounder, But No Urgency To Buy Today

Is Citigroup A 'Buy' Following The Fed's Stress Tests?

-

What's the price of Bank of America stock today?

One share of Bank of America stock can currently be purchased for approximately $48.17.

-

When is Bank of America's next earnings date?

Bank of America Corporation is estimated to report earnings on Wednesday, 15 Oct 2025.

-

Does Bank of America pay dividends?

Yes, Bank of America pays dividends and its trailing 12-month yield is 2.26% with 40% payout ratio. The last Bank of America stock dividend of $0.21 was paid on 31 Dec 2021.

-

How much money does Bank of America make?

Bank of America has a market capitalization of 336.45B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 3.82% to 98.58B US dollars. Bank of America earned 26.52B US dollars in net income (profit) last year or $0.81 on an earnings per share basis.

-

What is Bank of America's stock symbol?

Bank of America Corporation is traded on the NYSE under the ticker symbol "BAC".

-

What is Bank of America's primary industry?

Company operates in the Financial Services sector and Banks - Diversified industry.

-

How do i buy shares of Bank of America?

Shares of Bank of America can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are Bank of America's key executives?

Bank of America's management team includes the following people:

- Mr. Geoffrey S. Greener Chief Risk Officer(age: 60, pay: $5,440,000)

- Mr. Paul M. Donofrio Vice Chairman(age: 65, pay: $5,440,000)

- Mr. Dean C. Athanasia Pres of Regional Banking(age: 58, pay: $5,280,000)

- Mr. Brian Thomas Moynihan Chairman, Chief Executive Officer & Pres(age: 66, pay: $1,740,000)

-

How many employees does Bank of America have?

As Jul 2024, Bank of America employs 212,000 workers, which is 0% less then previous quarter.

-

When Bank of America went public?

Bank of America Corporation is publicly traded company for more then 52 years since IPO on 21 Feb 1973.

-

What is Bank of America's official website?

The official website for Bank of America is bankofamerica.com.

-

Where are Bank of America's headquarters?

Bank of America is headquartered at Bank of America Corporate Center, Charlotte, NC.

-

How can i contact Bank of America?

Bank of America's mailing address is Bank of America Corporate Center, Charlotte, NC and company can be reached via phone at +7 043865681.

-

What is Bank of America stock forecast & price target?

Based on 5 Wall Street analysts` predicted price targets for Bank of America in the last 12 months, the avarage price target is $46.4. The average price target represents a -3.66% change from the last price of $48.17.

Bank of America company profile:

Bank of America Corporation

bankofamerica.comNYSE

213,000

Banks - Diversified

Financial Services

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. As of December 31, 2021, it served approximately 67 million consumer and small business clients with approximately 4,200 retail financial centers; approximately 16,000 ATMs; and digital banking platforms with approximately 41 million active users. The company was founded in 1784 and is based in Charlotte, North Carolina.

Charlotte, NC 28255

CIK: 0000070858

ISIN: US0605051046

CUSIP: 060505104