Best Buy Co., Inc. – NYSE:BBY

Best Buy Co. stock price today

Best Buy Co. stock price monthly change

Best Buy Co. stock price quarterly change

Best Buy Co. stock price yearly change

Best Buy Co. key metrics

Market Cap | 18.23B |

Enterprise value | 22.24B |

P/E | 14.88 |

EV/Sales | 0.52 |

EV/EBITDA | 8.23 |

Price/Sales | 0.44 |

Price/Book | 6.13 |

PEG ratio | -0.23 |

EPS | 9.04 |

Revenue | 57.65B |

EBITDA | 3.78B |

Income | 2.08B |

Revenue Q/Q | N/A |

Revenue Y/Y | N/A |

Profit margin | 3.01% |

Oper. margin | 4.24% |

Gross margin | 22.41% |

EBIT margin | 4.24% |

EBITDA margin | 6.57% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeBest Buy Co. stock price history

Best Buy Co. stock forecast

Best Buy Co. financial statements

| Oct 2021 | 11.91B | 499M | 4.19% |

|---|---|---|---|

| Jan 2022 | 16.36B | 626M | 3.83% |

| Jan 2023 | 14.73B | 495M | 3.36% |

| Feb 2024 | 14.64B | 460M | 3.14% |

| Nov 2025 | 10.31B | 358.94M | 3.48% |

|---|---|---|---|

| Nov 2025 | 9.96B | 323.56M | 3.25% |

| Feb 2026 | 14.73B | 680.67M | 4.62% |

| Feb 2026 | 14.32B | 600.64M | 4.19% |

Analysts Price target

Financials & Ratios estimates

| Payout ratio | 63.39% |

|---|

| 2020 | 2.35% |

|---|---|

| 2021 | 2.01% |

| 2022 | 2.86% |

| 2023 | 4.12% |

| 2024 | 4.86% |

| Jul 2022 | 15419000000 | 12.52B | 81.24% |

|---|---|---|---|

| Oct 2022 | 17021000000 | 14.02B | 82.42% |

| Jan 2023 | 15803000000 | 13.00B | 82.31% |

| Feb 2024 | 14967000000 | 11.91B | 79.6% |

| Oct 2021 | 197M | -349M | -685M |

|---|---|---|---|

| Jan 2022 | 2.19B | -665M | -1.95B |

| Jan 2023 | 1.93B | -226M | -748M |

| Feb 2024 | 1.18B | -181M | -272M |

Best Buy Co. alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

Best Buy Competitors

| Aug 2023 | 0.494 | 0.229 | 0.142 | 0.132 |

|---|---|---|---|---|

| Sep 2023 | 0.492 | 0.213 | 0.141 | 0.153 |

| Oct 2023 | 0.461 | 0.249 | 0.149 | 0.139 |

| Nov 2023 | 0.467 | 0.239 | 0.173 | 0.118 |

| Dec 2023 | 0.447 | 0.295 | 0.156 | 0.100 |

| Jan 2024 | 0.457 | 0.261 | 0.146 | 0.134 |

| Feb 2024 | 0.464 | 0.251 | 0.162 | 0.122 |

| Mar 2024 | 0.478 | 0.258 | 0.136 | 0.126 |

| Apr 2024 | 0.485 | 0.262 | 0.123 | 0.128 |

| May 2024 | 0.480 | 0.252 | 0.125 | 0.141 |

| Jun 2024 | 0.462 | 0.279 | 0.121 | 0.136 |

| Jul 2024 | 0.508 | 0.250 | 0.118 | 0.122 |

| Aug 2024 | 0.457 | 0.276 | 0.130 | 0.134 |

| Sep 2024 | 0.475 | 0.257 | 0.135 | 0.131 |

| Oct 2024 | 0.462 | 0.279 | 0.121 | 0.136 |

| Nov 2024 | 0.456 | 0.253 | 0.160 | 0.130 |

| Dec 2024 | 0.443 | 0.287 | 0.146 | 0.122 |

| Jan 2025 | 0.474 | 0.242 | 0.135 | 0.147 |

| Feb 2025 | 0.424 | 0.265 | 0.148 | 0.161 |

| Mar 2025 | 0.465 | 0.251 | 0.133 | 0.150 |

| Apr 2025 | 0.483 | 0.261 | 0.128 | 0.127 |

| May 2025 | 0.449 | 0.281 | 0.128 | 0.139 |

| Aug 2023 | 36 |

|---|---|

| Sep 2023 | 37 |

| Oct 2023 | 18 |

| Nov 2023 | 10 |

| Dec 2023 | 21 |

| Jan 2024 | 31 |

| Feb 2024 | 28 |

| Mar 2024 | 28 |

| Apr 2024 | 32 |

| May 2024 | 25 |

| Jun 2024 | 26 |

| Aug 2023 | 258 |

|---|---|

| Sep 2023 | 206 |

| Oct 2023 | 180 |

| Nov 2023 | 80 |

| Dec 2023 | 127 |

| Jan 2024 | 214 |

| Feb 2024 | 195 |

| Mar 2024 | 200 |

| Apr 2024 | 201 |

| May 2024 | 198 |

| Jun 2024 | 178 |

Best Buy Co. Social Media Accounts

| May 2025 | 558464 |

|---|---|

| Jul 2025 | 563906 |

| Aug 2025 | 570756 |

| May 2025 | 133412 |

|---|---|

| Jul 2025 | 133768 |

| Aug 2025 | 133785 |

Best Buy

| 21 May 2023 | 33 |

|---|---|

| 28 May 2023 | 34 |

| 4 Jun 2023 | 33 |

| 11 Jun 2023 | 38 |

| 18 Jun 2023 | 31 |

| 25 Jun 2023 | 29 |

| 2 Jul 2023 | 27 |

| 9 Jul 2023 | 34 |

| 16 Jul 2023 | 29 |

| 23 Jul 2023 | 33 |

| 30 Jul 2023 | 32 |

| 6 Aug 2023 | 55 |

| 13 Aug 2023 | 50 |

| 20 Aug 2023 | 87 |

| 27 Aug 2023 | 68 |

| 3 Sep 2023 | 46 |

| 10 Sep 2023 | 61 |

| 17 Sep 2023 | 59 |

| 24 Sep 2023 | 47 |

| 1 Oct 2023 | 38 |

Best Buy Competitors

| 26 Feb 2023 | 15 | 51 | 24 | 19 |

|---|---|---|---|---|

| 5 Mar 2023 | 15 | 51 | 23 | 18 |

| 12 Mar 2023 | 15 | 53 | 22 | 18 |

| 19 Mar 2023 | 16 | 50 | 24 | 17 |

| 26 Mar 2023 | 14 | 47 | 21 | 17 |

| 2 Apr 2023 | 13 | 47 | 20 | 17 |

| 9 Apr 2023 | 13 | 45 | 20 | 17 |

| 16 Apr 2023 | 15 | 48 | 22 | 18 |

| 23 Apr 2023 | 13 | 50 | 21 | 18 |

| 30 Apr 2023 | 13 | 52 | 22 | 18 |

| 7 May 2023 | 14 | 51 | 21 | 17 |

| 14 May 2023 | 25 | 77 | 32 | 22 |

| 21 May 2023 | 22 | 67 | 29 | 23 |

| 28 May 2023 | 41 | 96 | 40 | 27 |

| 4 Jun 2023 | 29 | 70 | 32 | 22 |

| 11 Jun 2023 | 21 | 67 | 31 | 21 |

| 18 Jun 2023 | 26 | 65 | 33 | 21 |

| 25 Jun 2023 | 25 | 83 | 38 | 23 |

| 2 Jul 2023 | 21 | 66 | 29 | 23 |

| 9 Jul 2023 | 18 | 52 | 23 | 18 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 52,200 |

|---|---|

| Oct 2023 | 52,200 |

| Nov 2023 | 52,200 |

| Dec 2023 | 52,200 |

| Jan 2024 | 52,200 |

| Feb 2024 | 52,200 |

| Mar 2024 | 85,000 |

| Apr 2024 | 85,000 |

| May 2024 | 85,000 |

| Jun 2024 | 85,000 |

| Jul 2024 | 85,000 |

Best Buy Co. other data

| Period | Buy | Sel |

|---|---|---|

| May 2024 | 0 | 2000000 |

| Jun 2024 | 0 | 1004319 |

| Jul 2024 | 0 | 2003500 |

| Aug 2024 | 0 | 65169 |

| Sep 2024 | 0 | 79829 |

| Dec 2024 | 0 | 69166 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 20,116 | $51.65 | $1,038,991 | ||

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 20,116 | $51.65 | $1,038,991 | ||

Sale | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 3,999 | $87.91 | $351,552 | ||

Sale | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 3,999 | $87.91 | $351,552 | ||

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 49,050 | $69.11 | $3,389,846 | ||

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 49,050 | $69.11 | $3,389,846 | ||

Sale | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 65,167 | $87.43 | $5,697,355 | ||

Sale | BILUNAS MATTHEW M officer: SEVP Ent.. | Common Stock | 65,167 | $87.43 | $5,697,355 | ||

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Stock Option (Right to Buy) | 69,166 | $60.38 | $4,176,243 | ||

Option | BILUNAS MATTHEW M officer: SEVP Ent.. | Stock Option (Right to Buy) | 69,166 | $60.38 | $4,176,243 |

| Quarter | Transcript |

|---|---|

| Q1 2025 30 May 2024 | Q1 2025 Earnings Call Transcript |

| Q4 2024 29 Feb 2024 | Q4 2024 Earnings Call Transcript |

| Q3 2024 21 Nov 2023 | Q3 2024 Earnings Call Transcript |

| Q2 2024 29 Aug 2023 | Q2 2024 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

| Ms. Corie Sue Barry (1975) Chief Executive Officer & Director | $3,330,000 |

Ms. Kamy Scarlett (1964) Chief HR Officer | $1,990,000 |

| Mr. Matthew M. Bilunas (1973) Chief Financial Officer | $1,890,000 |

| Mr. Todd Gregory Hartman (1967) Executive Vice President, Gen. Counsel, Sec. & Chief Risk Officer | $1,570,000 |

Home Depot: I Know It's Overvalued, But Core Strengths And Technicals Are So Tempting That I Want To Add More (Rating Upgrade)

Amazon: 4 Reasons Why The Stock Remains A Strong Buy Heading Into Q2 Results

Best Buy: Rating Upgrade On Good Tariff Management And Positive Growth Outlook

Best Buy: An Attractive 5% Dividend Yield That Could Increase If Catalyst Plays Out

Best Buy On Sale? Tariff Fears Vs. Investment Opportunity

Best Buy: Short-Term Struggles Don't Define Long-Term Potential

Selling America, Buying Europe - My Picks

Recession-Proofing Your Portfolio

Best Buy: Close To The Beginning Of The New Cycle

-

What's the price of Best Buy Co. stock today?

One share of Best Buy Co. stock can currently be purchased for approximately $74.01.

-

When is Best Buy Co.'s next earnings date?

Unfortunately, Best Buy Co.'s (BBY) next earnings date is currently unknown.

-

Does Best Buy Co. pay dividends?

Yes, Best Buy Co. pays dividends and its trailing 12-month yield is 4.27% with 63% payout ratio. The last Best Buy Co. stock dividend of $0.7 was paid on 4 Jan 2022.

-

How much money does Best Buy Co. make?

Best Buy Co. has a market capitalization of 18.23B and it's past years’ income statements indicate that its last revenue has decreased compared to the previous period by 6.15% to 43.45B US dollars.

-

What is Best Buy Co.'s stock symbol?

Best Buy Co., Inc. is traded on the NYSE under the ticker symbol "BBY".

-

What is Best Buy Co.'s primary industry?

Company operates in the Consumer Cyclical sector and Specialty Retail industry.

-

How do i buy shares of Best Buy Co.?

Shares of Best Buy Co. can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are Best Buy Co.'s key executives?

Best Buy Co.'s management team includes the following people:

- Ms. Corie Sue Barry Chief Executive Officer & Director(age: 50, pay: $3,330,000)

- Ms. Kamy Scarlett Chief HR Officer(age: 61, pay: $1,990,000)

- Mr. Matthew M. Bilunas Chief Financial Officer(age: 52, pay: $1,890,000)

- Mr. Todd Gregory Hartman Executive Vice President, Gen. Counsel, Sec. & Chief Risk Officer(age: 58, pay: $1,570,000)

-

How many employees does Best Buy Co. have?

As Jul 2024, Best Buy Co. employs 85,000 workers.

-

When Best Buy Co. went public?

Best Buy Co., Inc. is publicly traded company for more then 40 years since IPO on 18 Apr 1985.

-

What is Best Buy Co.'s official website?

The official website for Best Buy Co. is investors.bestbuy.com.

-

Where are Best Buy Co.'s headquarters?

Best Buy Co. is headquartered at 7601 Penn Avenue South, Richfield, MN.

-

How can i contact Best Buy Co.?

Best Buy Co.'s mailing address is 7601 Penn Avenue South, Richfield, MN and company can be reached via phone at +61 22911000.

Best Buy Co. company profile:

Best Buy Co., Inc.

investors.bestbuy.comNYSE

85,000

Specialty Retail

Consumer Cyclical

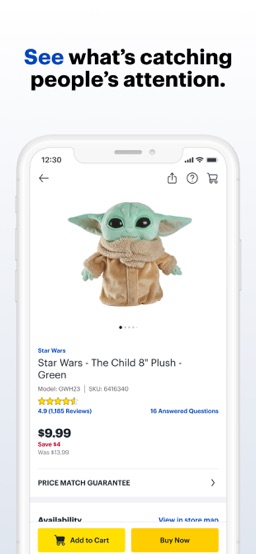

Best Buy Co., Inc. retails technology products in the United States and Canada. The company operates in two segments, Domestic and International. Its stores provide computing products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness, home theater, portable audio comprising headphones and portable speakers, and smart home products. The company's stores also offer appliances, such as dishwashers, laundry, ovens, refrigerators, blenders, coffee makers, and vacuums; entertainment products consisting of drones, peripherals, movies, music, and toys, as well as gaming hardware and software, and virtual reality and other software products; and other products, such as baby, food and beverage, luggage, outdoor living, and sporting goods. In addition, it provides consultation, delivery, design, health-related, installation, memberships, repair, set-up, technical support, and warranty-related services. The company offers its products through stores and websites under the Best Buy, Best Buy Ads, Best Buy Business, Best Buy Health, CST, Current Health, Geek Squad, Lively, Magnolia, Best Buy Mobile, Pacific Kitchen, Home, and Yardbird, as well as domain names bestbuy.com, currenthealth.com, lively.com, yardbird.com, and bestbuy.ca. As of January 30, 2022, it had 1,144 stores. The company was formerly known as Sound of Music, Inc. The company was incorporated in 1966 and is headquartered in Richfield, Minnesota.

Richfield, MN 55423

CIK: 0000764478

ISIN: US0865161014

CUSIP: 086516101