Booking Holdings Inc. – NASDAQ:BKNG

Booking Holdings stock price today

Booking Holdings stock price monthly change

Booking Holdings stock price quarterly change

Booking Holdings stock price yearly change

Booking Holdings key metrics

Market Cap | 166.03B |

Enterprise value | 167.66B |

P/E | 33.41 |

EV/Sales | 7.27 |

EV/EBITDA | 22.33 |

Price/Sales | 7.23 |

Price/Book | -46.05 |

PEG ratio | 10.15 |

EPS | 134.84 |

Revenue | 22.00B |

EBITDA | 7.41B |

Income | 4.79B |

Revenue Q/Q | 16.86% |

Revenue Y/Y | 21.06% |

Profit margin | 21.85% |

Oper. margin | 27.92% |

Gross margin | 97.03% |

EBIT margin | 27.92% |

EBITDA margin | 33.7% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeBooking Holdings stock price history

Booking Holdings stock forecast

Booking Holdings financial statements

$4,726.64

Potential downside: -15.35%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 5.46B | 1.29B | 23.62% |

|---|---|---|---|

| Sep 2023 | 7.34B | 2.51B | 34.21% |

| Dec 2023 | 4.78B | 222M | 4.64% |

| Mar 2024 | 4.41B | 776M | 17.58% |

| Jun 2023 | 26558000000 | 27.22B | 102.5% |

|---|---|---|---|

| Sep 2023 | 25635000000 | 26.26B | 102.44% |

| Dec 2023 | 24342000000 | 27.08B | 111.27% |

| Mar 2024 | 27728000000 | 31.78B | 114.61% |

| Jun 2023 | 1.73B | -39M | -1.22B |

|---|---|---|---|

| Sep 2023 | 1.37B | -22M | -2.63B |

| Dec 2023 | 1.34B | -39M | -2.49B |

| Mar 2024 | 2.70B | 69M | 784M |

Booking Holdings alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

Booking Competitors and Alternatives for Hosts

| Aug 2023 | 0.408 | 0.233 | 0.123 | 0.086 | 0.054 | 0.041 | 0.036 | 0.013 |

|---|---|---|---|---|---|---|---|---|

| Sep 2023 | 0.427 | 0.242 | 0.104 | 0.090 | 0.038 | 0.044 | 0.038 | 0.014 |

| Oct 2023 | 0.431 | 0.245 | 0.105 | 0.091 | 0.029 | 0.043 | 0.038 | 0.014 |

| Nov 2023 | 0.408 | 0.272 | 0.1 | 0.104 | 0.022 | 0.040 | 0.036 | 0.013 |

| Dec 2023 | 0.416 | 0.277 | 0.101 | 0.087 | 0.023 | 0.041 | 0.037 | 0.013 |

| Jan 2024 | 0.410 | 0.267 | 0.123 | 0.088 | 0.028 | 0.040 | 0.030 | 0.011 |

| Feb 2024 | 0.434 | 0.248 | 0.107 | 0.093 | 0.026 | 0.043 | 0.032 | 0.014 |

| Mar 2024 | 0.423 | 0.242 | 0.127 | 0.090 | 0.029 | 0.041 | 0.031 | 0.014 |

| Apr 2024 | 0.435 | 0.249 | 0.107 | 0.092 | 0.026 | 0.041 | 0.032 | 0.014 |

| May 2024 | 0.407 | 0.244 | 0.123 | 0.106 | 0.030 | 0.038 | 0.036 | 0.013 |

| Jun 2024 | 0.327 | 0.378 | 0.098 | 0.090 | 0.032 | 0.031 | 0.029 | 0.010 |

| Jul 2024 | 0.328 | 0.343 | 0.120 | 0.087 | 0.048 | 0.031 | 0.029 | 0.010 |

| Aug 2024 | 0.345 | 0.282 | 0.126 | 0.108 | 0.045 | 0.041 | 0.037 | 0.011 |

| Sep 2024 | 0.249 | 0.520 | 0.074 | 0.077 | 0.022 | 0.026 | 0.022 | 0.006 |

| Oct 2024 | 0.240 | 0.525 | 0.071 | 0.074 | 0.023 | 0.030 | 0.026 | 0.007 |

| Nov 2024 | 0.351 | 0.256 | 0.085 | 0.195 | 0.017 | 0.045 | 0.038 | 0.009 |

| Dec 2024 | 0.386 | 0.281 | 0.115 | 0.097 | 0.023 | 0.043 | 0.042 | 0.010 |

| Jan 2025 | 0.431 | 0.247 | 0.130 | 0.075 | 0.034 | 0.038 | 0.032 | 0.009 |

| Feb 2025 | 0.406 | 0.262 | 0.121 | 0.085 | 0.033 | 0.041 | 0.036 | 0.010 |

| Mar 2025 | 0.424 | 0.233 | 0.128 | 0.089 | 0.033 | 0.041 | 0.038 | 0.011 |

| Apr 2025 | 0.391 | 0.261 | 0.117 | 0.100 | 0.037 | 0.037 | 0.042 | 0.010 |

| May 2025 | 0.415 | 0.228 | 0.125 | 0.087 | 0.042 | 0.040 | 0.045 | 0.013 |

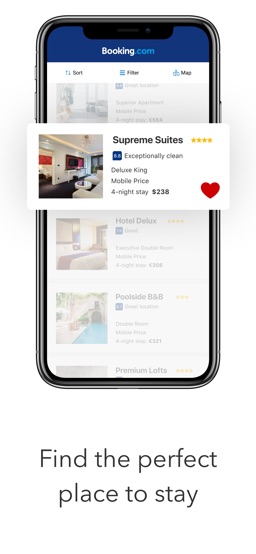

Booking.com: Hotels, Apartments & Accommodation

| Platform: | Android |

| Store: | Google Play |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 1 |

|---|---|

| Sep 2023 | 8 |

| Oct 2023 | 8 |

| Nov 2023 | 11 |

| Dec 2023 | 1 |

| Jan 2024 | 6 |

| Feb 2024 | 7 |

| Mar 2024 | 9 |

| Apr 2024 | 5 |

| May 2024 | 7 |

| Jun 2024 | 5 |

| Jul 2024 | 3 |

| Aug 2024 | 4 |

| Sep 2024 | 4 |

| Oct 2024 | 9 |

| Nov 2024 | 7 |

| Dec 2024 | 5 |

Booking.com: Hotels & Travel

| Platform: | iOS |

| Store: | App Store |

| Type: | Free |

| Market: | United States |

| Aug 2023 | 98 |

|---|---|

| Sep 2023 | 127 |

| Oct 2023 | 190 |

| Nov 2023 | 230 |

| Dec 2023 | 180 |

| Jan 2024 | 186 |

| Feb 2024 | 137 |

| Mar 2024 | 143 |

| Apr 2024 | 107 |

| May 2024 | 86 |

| Jun 2024 | 73 |

| Jul 2024 | 100 |

| Aug 2024 | 119 |

| Sep 2024 | 126 |

| Oct 2024 | 176 |

| Nov 2024 | 172 |

| Dec 2024 | 163 |

Booking Holdings Social Media Accounts

| May 2025 | 3937063 |

|---|---|

| Jul 2025 | 4255455 |

| Aug 2025 | 4459883 |

Booking.com Competitors

| 19 Feb 2023 | 10 | 17 | 17 | 8 | 70 |

|---|---|---|---|---|---|

| 26 Feb 2023 | 10 | 17 | 17 | 7 | 69 |

| 5 Mar 2023 | 9 | 16 | 16 | 7 | 63 |

| 12 Mar 2023 | 7 | 13 | 15 | 7 | 56 |

| 19 Mar 2023 | 6 | 12 | 14 | 8 | 55 |

| 26 Mar 2023 | 6 | 11 | 13 | 7 | 55 |

| 2 Apr 2023 | 5 | 9 | 12 | 7 | 49 |

| 9 Apr 2023 | 5 | 9 | 10 | 7 | 44 |

| 16 Apr 2023 | 4 | 8 | 10 | 7 | 44 |

| 23 Apr 2023 | 4 | 7 | 9 | 7 | 46 |

| 30 Apr 2023 | 4 | 7 | 9 | 7 | 42 |

| 7 May 2023 | 4 | 7 | 8 | 6 | 40 |

| 14 May 2023 | 3 | 6 | 6 | 6 | 38 |

| 21 May 2023 | 3 | 6 | 5 | 5 | 38 |

| 28 May 2023 | 3 | 6 | 5 | 6 | 39 |

| 4 Jun 2023 | 3 | 6 | 4 | 5 | 42 |

| 11 Jun 2023 | 3 | 7 | 5 | 5 | 40 |

| 18 Jun 2023 | 3 | 6 | 5 | 5 | 41 |

| 25 Jun 2023 | 3 | 6 | 5 | 5 | 42 |

| 2 Jul 2023 | 3 | 6 | 5 | 5 | 42 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Aug 2023 | 118 |

|---|---|

| Sep 2023 | 123 |

| Oct 2023 | 135 |

| Nov 2023 | 137 |

| Dec 2023 | 124 |

| Jan 2024 | 121 |

| Feb 2024 | 130 |

| Apr 2024 | 120 |

| May 2024 | 121 |

| Jun 2024 | 107 |

| Jul 2024 | 113 |

| Aug 2023 | 22,400 |

|---|---|

| Sep 2023 | 23,100 |

| Oct 2023 | 23,100 |

| Nov 2023 | 23,100 |

| Dec 2023 | 23,450 |

| Jan 2024 | 23,450 |

| Feb 2024 | 23,450 |

| Mar 2024 | 23,364 |

| Apr 2024 | 23,364 |

| May 2024 | 23,364 |

| Jun 2024 | 24,000 |

| Jul 2024 | 24,000 |

Booking Holdings other data

| Period | Buy | Sel |

|---|---|---|

| Dec 2023 | 0 | 1838 |

| Jan 2024 | 0 | 1778 |

| Feb 2024 | 0 | 59 |

| Mar 2024 | 0 | 10877 |

| Apr 2024 | 0 | 772 |

| May 2024 | 0 | 1297 |

| Jun 2024 | 0 | 750 |

| Jul 2024 | 0 | 750 |

| Aug 2024 | 0 | 958 |

| Nov 2024 | 0 | 170 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Sale | PISANO PAULO officer: CHIEF HUMAN RESOURCES .. | Common Stock | 170 | $5,165.71 | $878,170 | ||

Sale | PISANO PAULO officer: CHIEF HUMAN RESOURCES .. | Common Stock | 100 | $3,887.61 | $388,761 | ||

Sale | D'EMIC SUSANA officer: SVP, CAO & CONTROLLER | Common Stock | 458 | $3,614.01 | $1,655,218 | ||

Sale | D'EMIC SUSANA officer: SVP, CAO & CONTROLLER | Common Stock | 200 | $3,614.98 | $722,997 | ||

Sale | D'EMIC SUSANA officer: SVP, CAO & CONTROLLER | Common Stock | 200 | $3,616 | $723,200 | ||

Sale | FOGEL GLENN D director, officer.. | Common Stock | 37 | $4,027.31 | $149,010 | ||

Sale | FOGEL GLENN D director, officer.. | Common Stock | 37 | $4,028.31 | $149,047 | ||

Sale | FOGEL GLENN D director, officer.. | Common Stock | 37 | $4,031.66 | $149,171 | ||

Sale | FOGEL GLENN D director, officer.. | Common Stock | 37 | $4,040.28 | $149,490 | ||

Sale | FOGEL GLENN D director, officer.. | Common Stock | 44 | $4,045.53 | $178,003 |

| Quarter | Transcript |

|---|---|

| Q1 2024 2 May 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 22 Feb 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 2 Nov 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 3 Aug 2023 | Q2 2023 Earnings Call Transcript |

Wedgewood Partners: Q2 2025 Top Performers And Detractors

Booking Holdings: Fairly Valued Market Leader With Margin Expansion Opportunities

How trivago Is A Value Trap

Expedia: No Market Respect Yet

Booking Holdings: Quietly Killing The Competition And Crushing The Market

Booking Holdings: What Trade War?

Selling America, Buying Europe - My Picks

Booking Stock: This Travel Titan Quietly Prints Cash

Booking Holdings: The One Stop Shop Of The Tourism Sector

-

What's the price of Booking Holdings stock today?

One share of Booking Holdings stock can currently be purchased for approximately $5,584.08.

-

When is Booking Holdings's next earnings date?

Unfortunately, Booking Holdings's (BKNG) next earnings date is currently unknown.

-

Does Booking Holdings pay dividends?

Yes, Booking Holdings pays dividends and its trailing 12-month yield is 0.69% with 18% payout ratio. The last Booking Holdings stock dividend of undefined was paid on 5 Nov 2025.

-

How much money does Booking Holdings make?

Booking Holdings has a market capitalization of 166.03B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 25.01% to 21.37B US dollars.

-

What is Booking Holdings's stock symbol?

Booking Holdings Inc. is traded on the NASDAQ under the ticker symbol "BKNG".

-

What is Booking Holdings's primary industry?

Company operates in the Consumer Cyclical sector and Travel Services industry.

-

How do i buy shares of Booking Holdings?

Shares of Booking Holdings can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are Booking Holdings's key executives?

Booking Holdings's management team includes the following people:

- Mr. David I. Goulden Executive Vice President & Chief Financial Officer(age: 65, pay: $1,420,000)

- Mr. Peter J. Millones Jr. Executive Vice President, Gen. Counsel & Corporation Sec.(age: 55, pay: $1,180,000)

- Mr. Glenn D. Fogel Pres, Chief Executive Officer & Director(age: 63, pay: $194,560)

-

How many employees does Booking Holdings have?

As Jul 2024, Booking Holdings employs 24,000 workers, which is 3% more then previous quarter.

-

When Booking Holdings went public?

Booking Holdings Inc. is publicly traded company for more then 26 years since IPO on 31 Mar 1999.

-

What is Booking Holdings's official website?

The official website for Booking Holdings is bookingholdings.com.

-

Where are Booking Holdings's headquarters?

Booking Holdings is headquartered at 800 Connecticut Avenue, Norwalk, CT.

-

How can i contact Booking Holdings?

Booking Holdings's mailing address is 800 Connecticut Avenue, Norwalk, CT and company can be reached via phone at +20 3 2998000.

-

What is Booking Holdings stock forecast & price target?

Based on 12 Wall Street analysts` predicted price targets for Booking Holdings in the last 12 months, the avarage price target is $4,726.64. The average price target represents a -15.35% change from the last price of $5,584.08.

Booking Holdings company profile:

Booking Holdings Inc.

bookingholdings.comNASDAQ

24,200

Travel Services

Consumer Cyclical

Booking Holdings Inc. provides travel and restaurant online reservation and related services worldwide. The company operates Booking.com, which offers online accommodation reservations; Rentalcars.com that provides online rental car reservation services; Priceline, which offer online travel reservation services, and consumers hotel, flight, and rental car reservation services, as well as vacation packages, cruises, and hotel distribution services. It also operates Agoda that provides online accommodation reservation services, as well as flight, ground transportation and activities reservation services. In addition, the company operates KAYAK, an online price comparison service that allows consumers to search and compare travel itineraries and prices, comprising airline ticket, accommodation reservation, and rental car reservation information; and OpenTable for booking online restaurant reservations. Further, it offers travel-related insurance products, and restaurant management services to consumers, travel service providers, and restaurants. The company was formerly known as The Priceline Group Inc. and changed its name to Booking Holdings Inc. in February 2018. The company was founded in 1997 and is headquartered in Norwalk, Connecticut.

Norwalk, CT 06854

CIK: 0001075531

ISIN: US09857L1089

CUSIP: 09857L108