Next earnings date: 28 Oct 2025

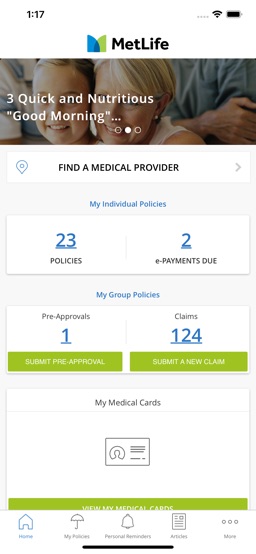

MetLife, Inc. – NYSE:MET

MetLife stock price today

MetLife stock price monthly change

MetLife stock price quarterly change

MetLife stock price yearly change

MetLife key metrics

Market Cap | 56.25B |

Enterprise value | 54.03B |

P/E | 15.28 |

EV/Sales | 0.75 |

EV/EBITDA | -38.02 |

Price/Sales | 0.79 |

Price/Book | 1.86 |

PEG ratio | -0.93 |

EPS | 2.94 |

Revenue | 67.57B |

EBITDA | 1.57B |

Income | 2.36B |

Revenue Q/Q | 4.34% |

Revenue Y/Y | -2.71% |

Profit margin | 5.27% |

Oper. margin | 7.42% |

Gross margin | 100% |

EBIT margin | 7.42% |

EBITDA margin | 2.32% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeMetLife stock price history

MetLife stock forecast

MetLife financial statements

| Jun 2023 | 16.62B | 402M | 2.42% |

|---|---|---|---|

| Sep 2023 | 15.86B | 489M | 3.08% |

| Dec 2023 | 19.02B | 607M | 3.19% |

| Mar 2024 | 16.05B | 867M | 5.4% |

| Sep 2025 | 19.54B | 1.87B | 9.61% |

|---|---|---|---|

| Oct 2025 | 19.40B | 1.85B | 9.57% |

| Dec 2025 | 19.87B | 1.88B | 9.49% |

| Mar 2026 | 19.34B | 1.85B | 9.57% |

Analysts Price target

Financials & Ratios estimates

| 2024-10-30 | 2.17 | 1.95 |

|---|

| Payout ratio | 46.15% |

|---|

| 2019 | 3.81% |

|---|---|

| 2020 | 4.36% |

| 2021 | 3.42% |

| 2022 | 3.07% |

| 2023 | 3.5% |

| Jun 2023 | 677279000000 | 646.78B | 95.5% |

|---|---|---|---|

| Sep 2023 | 652120000000 | 626.22B | 96.03% |

| Dec 2023 | 687584000000 | 657.33B | 95.6% |

| Mar 2024 | 677576000000 | 648.78B | 95.75% |

| Jun 2023 | 3.03B | -6.34B | 379M |

|---|---|---|---|

| Sep 2023 | 3.47B | -2.97B | -848M |

| Dec 2023 | 5.18B | 576M | -176M |

| Mar 2024 | 2.32B | -2.62B | -261M |

MetLife alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

Life Insurance Companies

| Aug 2023 | 0.475 | 0.318 | 0.048 | 0.045 | 0.040 | 0.025 | 0.023 | 0.012 | 0.005 | 0.004 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sep 2023 | 0.464 | 0.331 | 0.041 | 0.045 | 0.041 | 0.026 | 0.024 | 0.015 | 0.004 | 0.005 |

| Oct 2023 | 0.428 | 0.351 | 0.045 | 0.050 | 0.044 | 0.028 | 0.025 | 0.013 | 0.006 | 0.005 |

| Nov 2023 | 0.462 | 0.310 | 0.048 | 0.045 | 0.048 | 0.031 | 0.028 | 0.013 | 0.005 | 0.005 |

| Dec 2023 | 0.581 | 0.242 | 0.037 | 0.035 | 0.036 | 0.024 | 0.024 | 0.010 | 0.004 | 0.004 |

| Jan 2024 | 0.580 | 0.241 | 0.037 | 0.034 | 0.037 | 0.024 | 0.024 | 0.009 | 0.004 | 0.005 |

| Feb 2024 | 0.583 | 0.243 | 0.037 | 0.030 | 0.031 | 0.029 | 0.026 | 0.009 | 0.004 | 0.004 |

| Mar 2024 | 0.588 | 0.245 | 0.031 | 0.030 | 0.036 | 0.024 | 0.025 | 0.009 | 0.004 | 0.004 |

| Apr 2024 | 0.552 | 0.271 | 0.034 | 0.028 | 0.040 | 0.027 | 0.024 | 0.010 | 0.004 | 0.004 |

| May 2024 | 0.558 | 0.274 | 0.034 | 0.025 | 0.041 | 0.023 | 0.024 | 0.009 | 0.004 | 0.004 |

| Jun 2024 | 0.499 | 0.363 | 0.029 | 0.023 | 0.030 | 0.019 | 0.020 | 0.008 | 0.003 | 0.003 |

| Jul 2024 | 0.486 | 0.362 | 0.033 | 0.024 | 0.035 | 0.022 | 0.019 | 0.008 | 0.003 | 0.003 |

| Aug 2024 | 0.505 | 0.343 | 0.030 | 0.023 | 0.036 | 0.023 | 0.021 | 0.008 | 0.003 | 0.003 |

| Sep 2024 | 0.469 | 0.371 | 0.036 | 0.025 | 0.032 | 0.025 | 0.023 | 0.007 | 0.003 | 0.003 |

| Oct 2024 | 0.501 | 0.340 | 0.038 | 0.021 | 0.033 | 0.023 | 0.026 | 0.007 | 0.003 | 0.003 |

| Nov 2024 | 0.470 | 0.369 | 0.034 | 0.023 | 0.034 | 0.022 | 0.029 | 0.007 | 0.003 | 0.005 |

| Dec 2024 | 0.473 | 0.372 | 0.033 | 0.023 | 0.033 | 0.022 | 0.024 | 0.007 | 0.003 | 0.004 |

| Jan 2025 | 0.471 | 0.369 | 0.033 | 0.025 | 0.035 | 0.026 | 0.022 | 0.006 | 0.003 | 0.004 |

| Feb 2025 | 0.454 | 0.372 | 0.040 | 0.024 | 0.041 | 0.026 | 0.023 | 0.008 | 0.004 | 0.004 |

| Mar 2025 | 0.434 | 0.396 | 0.036 | 0.025 | 0.035 | 0.028 | 0.027 | 0.007 | 0.004 | 0.004 |

| Apr 2025 | 0.437 | 0.399 | 0.037 | 0.023 | 0.036 | 0.024 | 0.025 | 0.007 | 0.003 | 0.004 |

| May 2025 | 0.438 | 0.400 | 0.037 | 0.021 | 0.040 | 0.026 | 0.020 | 0.006 | 0.003 | 0.004 |

| Aug 2023 | 28 |

|---|---|

| Sep 2023 | 33 |

| Oct 2023 | 38 |

| Nov 2023 | 40 |

| Dec 2023 | 56 |

| Jan 2024 | 38 |

| Feb 2024 | 37 |

| Mar 2024 | 28 |

| Apr 2024 | 41 |

| May 2024 | 32 |

| Jun 2024 | 35 |

| Aug 2023 | 120 |

|---|---|

| Oct 2023 | 196 |

| Jan 2024 | 138 |

| Feb 2024 | 166 |

| Aug 2023 | 42 |

|---|---|

| Sep 2023 | 52 |

| Oct 2023 | 51 |

| Nov 2023 | 49 |

| Dec 2023 | 57 |

| Jan 2024 | 43 |

| Feb 2024 | 51 |

| Mar 2024 | 50 |

| Apr 2024 | 45 |

| May 2024 | 40 |

| Jun 2024 | 51 |

| Aug 2023 | 363 |

|---|---|

| Sep 2023 | 192 |

| Oct 2023 | 220 |

| Nov 2023 | 242 |

| Dec 2023 | 308 |

| Jan 2024 | 258 |

| Feb 2024 | 253 |

| Mar 2024 | 340 |

| Apr 2024 | 143 |

| May 2024 | 266 |

| Jun 2024 | 290 |

| Aug 2023 | 159 |

|---|---|

| Sep 2023 | 164 |

| Oct 2023 | 151 |

| Nov 2023 | 145 |

| Dec 2023 | 142 |

| Jan 2024 | 98 |

| Feb 2024 | 116 |

| Mar 2024 | 174 |

| Apr 2024 | 150 |

| May 2024 | 142 |

| Jun 2024 | 190 |

Life Insurance Companies

| 12 Feb 2023 | 58 | 38 | 1 | 6 | 74 |

|---|---|---|---|---|---|

| 19 Feb 2023 | 46 | 36 | 1 | 5 | 79 |

| 26 Feb 2023 | 49 | 46 | 2 | 5 | 67 |

| 5 Mar 2023 | 47 | 48 | 2 | 6 | 72 |

| 12 Mar 2023 | 46 | 33 | 2 | 5 | 70 |

| 19 Mar 2023 | 46 | 36 | 2 | 6 | 66 |

| 26 Mar 2023 | 48 | 33 | 2 | 5 | 63 |

| 2 Apr 2023 | 52 | 34 | 2 | 5 | 62 |

| 9 Apr 2023 | 58 | 32 | 1 | 4 | 61 |

| 16 Apr 2023 | 51 | 35 | 2 | 5 | 67 |

| 23 Apr 2023 | 49 | 32 | 2 | 4 | 66 |

| 30 Apr 2023 | 47 | 33 | 2 | 5 | 61 |

| 7 May 2023 | 47 | 34 | 2 | 4 | 61 |

| 14 May 2023 | 45 | 30 | 1 | 4 | 66 |

| 21 May 2023 | 46 | 32 | 1 | 4 | 69 |

| 28 May 2023 | 44 | 32 | 2 | 4 | 71 |

| 4 Jun 2023 | 39 | 28 | 1 | 3 | 61 |

| 11 Jun 2023 | 44 | 31 | 2 | 5 | 71 |

| 18 Jun 2023 | 46 | 31 | 2 | 5 | 68 |

| 25 Jun 2023 | 45 | 31 | 2 | 5 | 65 |

MetLife

| 26 Feb 2023 | 46 |

|---|---|

| 5 Mar 2023 | 45 |

| 12 Mar 2023 | 43 |

| 19 Mar 2023 | 41 |

| 26 Mar 2023 | 42 |

| 2 Apr 2023 | 39 |

| 9 Apr 2023 | 45 |

| 16 Apr 2023 | 51 |

| 23 Apr 2023 | 51 |

| 30 Apr 2023 | 45 |

| 7 May 2023 | 41 |

| 14 May 2023 | 40 |

| 21 May 2023 | 42 |

| 28 May 2023 | 40 |

| 4 Jun 2023 | 43 |

| 11 Jun 2023 | 41 |

| 18 Jun 2023 | 35 |

| 25 Jun 2023 | 39 |

| 2 Jul 2023 | 41 |

| 9 Jul 2023 | 39 |

Types of Insurance

| 12 Feb 2023 | 3 | 83 | 39 | 37 | 17 |

|---|---|---|---|---|---|

| 19 Feb 2023 | 2 | 82 | 36 | 34 | 17 |

| 26 Feb 2023 | 3 | 87 | 35 | 33 | 16 |

| 5 Mar 2023 | 3 | 87 | 34 | 36 | 17 |

| 12 Mar 2023 | 2 | 89 | 37 | 33 | 17 |

| 19 Mar 2023 | 2 | 86 | 36 | 31 | 16 |

| 26 Mar 2023 | 3 | 83 | 34 | 31 | 16 |

| 2 Apr 2023 | 3 | 88 | 31 | 30 | 16 |

| 9 Apr 2023 | 3 | 87 | 37 | 32 | 17 |

| 16 Apr 2023 | 3 | 86 | 34 | 32 | 16 |

| 23 Apr 2023 | 3 | 80 | 34 | 28 | 15 |

| 30 Apr 2023 | 3 | 80 | 30 | 28 | 15 |

| 7 May 2023 | 3 | 77 | 30 | 29 | 15 |

| 14 May 2023 | 2 | 71 | 31 | 25 | 13 |

| 21 May 2023 | 3 | 79 | 32 | 28 | 16 |

| 28 May 2023 | 3 | 81 | 29 | 30 | 16 |

| 4 Jun 2023 | 2 | 70 | 25 | 24 | 14 |

| 11 Jun 2023 | 2 | 83 | 31 | 29 | 14 |

| 18 Jun 2023 | 2 | 84 | 32 | 28 | 15 |

| 25 Jun 2023 | 2 | 81 | 26 | 26 | 15 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Aug 2023 | 459 |

|---|---|

| Sep 2023 | 466 |

| Oct 2023 | 475 |

| Jan 2025 | 258 |

| Feb 2025 | 380 |

| May 2025 | 342 |

| Jul 2025 | 235 |

| Aug 2025 | 246 |

| Aug 2023 | 45,000 |

|---|---|

| Sep 2023 | 45,000 |

| Oct 2023 | 45,000 |

| Nov 2023 | 45,000 |

| Dec 2023 | 45,000 |

| Jan 2024 | 45,000 |

| Feb 2024 | 45,000 |

| Apr 2024 | 45,000 |

| May 2024 | 45,000 |

| Jun 2024 | 45,000 |

| Jul 2024 | 45,000 |

MetLife other data

| Period | Buy | Sel |

|---|---|---|

| Feb 2024 | 0 | 20460 |

| Mar 2024 | 0 | 31026 |

| Dec 2024 | 0 | 43736 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Option | DEBEL MARLENE officer: EVP & Chief Risk Officer | Common Stock | 9,703 | $45.91 | $445,465 | ||

Option | DEBEL MARLENE officer: EVP & Chief Risk Officer | Common Stock | 13,107 | $34.33 | $449,963 | ||

Sale | DEBEL MARLENE officer: EVP & Chief Risk Officer | Common Stock | 22,810 | $82.88 | $1,890,584 | ||

Option | DEBEL MARLENE officer: EVP & Chief Risk Officer | Employee Stock Options (right to buy) | 22,810 | $40.12 | $915,137 | ||

Option | KHALAF MICHEL director, officer.. | Common Stock | 26,138 | $45.91 | $1,199,996 | ||

Option | KHALAF MICHEL director, officer.. | Common Stock | 26,138 | $45.91 | $1,199,996 | ||

Sale | KHALAF MICHEL director, officer.. | Common Stock | 20,926 | $82.85 | $1,733,614 | ||

Sale | KHALAF MICHEL director, officer.. | Common Stock | 20,926 | $82.85 | $1,733,614 | ||

Option | KHALAF MICHEL director, officer.. | Employee Stock Option (Right to Buy) | 26,138 | $45.91 | $1,199,996 | ||

Option | KHALAF MICHEL director, officer.. | Employee Stock Option (Right to Buy) | 26,138 | $45.91 | $1,199,996 |

| Quarter | Transcript |

|---|---|

| Q1 2024 2 May 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 1 Feb 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 2 Nov 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 3 Aug 2023 | Q2 2023 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

| Mr. Michel Abbas Khalaf (1964) Chief Executive Officer, Pres & Director | $5,830,000 |

| Mr. Bill Pappas (1970) Executive Vice President and Head of Global Technology & Operations | $4,680,000 |

Mr. John Dennis McCallion CPA (1974) Executive Vice President & Chief Financial Officer | $3,440,000 |

| Mr. Steven Jeffrey Goulart (1959) Executive Vice President & Chief Investment Officer | $3,140,000 |

| Mr. Ramy Tadros (1976) Executive Vice President & Pres of U.S. Bus. | $2,920,000 |

Aflac's Shares Are Overvalued

MetLife Looks Like An Undervalued Property In An Unpopular Neighborhood

MetLife: A Safe Bet To Hold As Future Earnings Growth Expected, And Tailwind From Rate Environment

Another Smashing Quarter For Apollo And How Long It Will Remain So Cheap

MetLife: Disappointing Growth But Safe Dividend

A New Era Approaches For AIG

Manulife: Taking A Closer Look At Canadian Life Insurance

MetLife: An Investment That Ensures Portfolios

MetLife: The Acquisition Of Raven Capital Should Accelerate Growth

-

What's the price of MetLife stock today?

One share of MetLife stock can currently be purchased for approximately $79.

-

When is MetLife's next earnings date?

MetLife, Inc. is estimated to report earnings on Tuesday, 28 Oct 2025.

-

Does MetLife pay dividends?

Yes, MetLife pays dividends and its trailing 12-month yield is 2.62% with 46% payout ratio. The last MetLife stock dividend of $0.48 was paid on 14 Mar 2022.

-

How much money does MetLife make?

MetLife has a market capitalization of 56.25B and it's past years’ income statements indicate that its last revenue has decreased compared to the previous period by 4.99% to 66.41B US dollars. MetLife earned 1.58B US dollars in net income (profit) last year or $1.95 on an earnings per share basis.

-

What is MetLife's stock symbol?

MetLife, Inc. is traded on the NYSE under the ticker symbol "MET".

-

What is MetLife's primary industry?

Company operates in the Financial Services sector and Insurance - Life industry.

-

How do i buy shares of MetLife?

Shares of MetLife can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are MetLife's key executives?

MetLife's management team includes the following people:

- Mr. Michel Abbas Khalaf Chief Executive Officer, Pres & Director(age: 61, pay: $5,830,000)

- Mr. Bill Pappas Executive Vice President and Head of Global Technology & Operations(age: 55, pay: $4,680,000)

- Mr. John Dennis McCallion CPA Executive Vice President & Chief Financial Officer(age: 51, pay: $3,440,000)

- Mr. Steven Jeffrey Goulart Executive Vice President & Chief Investment Officer(age: 66, pay: $3,140,000)

- Mr. Ramy Tadros Executive Vice President & Pres of U.S. Bus.(age: 49, pay: $2,920,000)

-

How many employees does MetLife have?

As Jul 2024, MetLife employs 45,000 workers.

-

When MetLife went public?

MetLife, Inc. is publicly traded company for more then 25 years since IPO on 5 Apr 2000.

-

What is MetLife's official website?

The official website for MetLife is metlife.com.

-

Where are MetLife's headquarters?

MetLife is headquartered at 200 Park Avenue, New York, NY.

-

How can i contact MetLife?

MetLife's mailing address is 200 Park Avenue, New York, NY and company can be reached via phone at +212 5789500.

MetLife company profile:

MetLife, Inc.

metlife.comNYSE

45,000

Insurance - Life

Financial Services

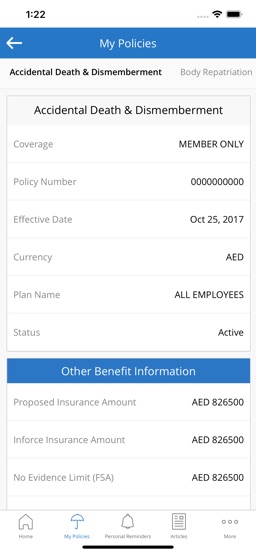

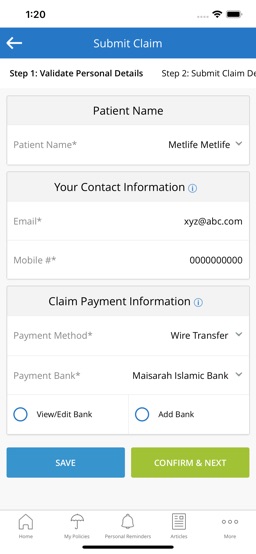

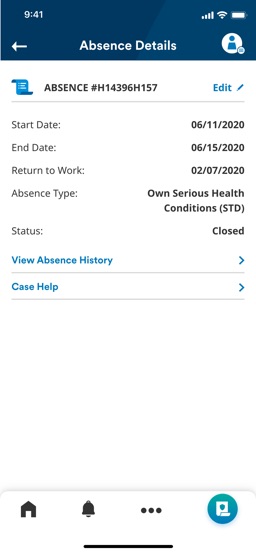

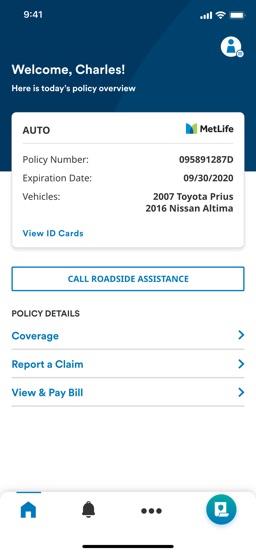

MetLife, Inc., a financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide. It operates through five segments: U.S.; Asia; Latin America; Europe, the Middle East and Africa; and MetLife Holdings. The company offers life, dental, group short-and long-term disability, individual disability, pet insurance, accidental death and dismemberment, vision, and accident and health coverages, as well as prepaid legal plans; administrative services-only arrangements to employers; and general and separate account, and synthetic guaranteed interest contracts, as well as private floating rate funding agreements. It also provides pension risk transfers, institutional income annuities, structured settlements, and capital markets investment products; and other products and services, such as life insurance products and funding agreements for funding postretirement benefits, as well as company, bank, or trust-owned life insurance used to finance nonqualified benefit programs for executives. In addition, it provides fixed, indexed-linked, and variable annuities; and pension products; regular savings products; whole and term life, endowments, universal and variable life, and group life products; longevity reinsurance solutions; credit insurance products; and protection against long-term health care services. MetLife, Inc. was founded in 1863 and is headquartered in New York, New York.

New York, NY 10166-0188

CIK: 0001099219

ISIN: US59156R1086

CUSIP: 59156R108