Next earnings date: 21 Oct 2025

ServiceNow, Inc. – NYSE:NOW

ServiceNow stock price today

ServiceNow stock price monthly change

ServiceNow stock price quarterly change

ServiceNow stock price yearly change

ServiceNow key metrics

Market Cap | 222.03B |

Enterprise value | 96.13B |

P/E | 291.81 |

EV/Sales | 13.26 |

EV/EBITDA | 111.91 |

Price/Sales | 13.16 |

Price/Book | 18.95 |

PEG ratio | 7.52 |

EPS | 9.43 |

Revenue | 9.47B |

EBITDA | 1.57B |

Income | 1.92B |

Revenue Q/Q | 24.18% |

Revenue Y/Y | 24.39% |

Profit margin | 4.49% |

Oper. margin | 4.9% |

Gross margin | 78.29% |

EBIT margin | 4.9% |

EBITDA margin | 16.6% |

create your own Smart Feed

Personalize your watchlist with companies you want to keep track of and get notified in the smart feed every time fresh news arrives.

Sign up for freeServiceNow stock price history

ServiceNow stock forecast

ServiceNow financial statements

$1,017.27

Potential upside: 15.19%

Analysts Price target

Financials & Ratios estimates

| Jun 2023 | 2.15B | 1.04B | 48.56% |

|---|---|---|---|

| Sep 2023 | 2.28B | 242M | 10.58% |

| Dec 2023 | 2.43B | 295M | 12.11% |

| Mar 2024 | 2.60B | 347M | 13.33% |

| 2024-10-23 | 3.45 | 3.72 |

|---|

| Jun 2023 | 14923000000 | 7.99B | 53.59% |

|---|---|---|---|

| Sep 2023 | 15091000000 | 7.90B | 52.41% |

| Dec 2023 | 17387000000 | 9.75B | 56.13% |

| Mar 2024 | 17544000000 | 9.43B | 53.79% |

| Jun 2023 | 580M | -674M | -94M |

|---|---|---|---|

| Sep 2023 | 311M | -525M | -333M |

| Dec 2023 | 1.60B | -444M | -381M |

| Mar 2024 | 1.34B | -918M | -259M |

ServiceNow alternative data

What is Share of Search?

🎓 Academy: Share of Search: A Powerful Tool for Your Investment Strategy

IT Service Management Competitors

| Aug 2023 | 0.489 | 0.277 | 0.184 | 0.025 | 0.022 |

|---|---|---|---|---|---|

| Sep 2023 | 0.493 | 0.318 | 0.142 | 0.024 | 0.020 |

| Oct 2023 | 0.508 | 0.288 | 0.157 | 0.022 | 0.023 |

| Nov 2023 | 0.476 | 0.329 | 0.147 | 0.025 | 0.021 |

| Dec 2023 | 0.485 | 0.313 | 0.140 | 0.035 | 0.025 |

| Jan 2024 | 0.434 | 0.341 | 0.153 | 0.047 | 0.022 |

| Feb 2024 | 0.424 | 0.334 | 0.150 | 0.068 | 0.021 |

| Mar 2024 | 0.438 | 0.344 | 0.155 | 0.038 | 0.022 |

| Apr 2024 | 0.408 | 0.343 | 0.188 | 0.031 | 0.027 |

| May 2024 | 0.425 | 0.357 | 0.161 | 0.027 | 0.028 |

| Jun 2024 | 0.423 | 0.334 | 0.183 | 0.025 | 0.032 |

| Jul 2024 | 0.413 | 0.368 | 0.165 | 0.023 | 0.029 |

| Aug 2024 | 0.397 | 0.381 | 0.171 | 0.023 | 0.025 |

| Sep 2024 | 0.426 | 0.336 | 0.184 | 0.025 | 0.026 |

| Oct 2024 | 0.392 | 0.377 | 0.169 | 0.023 | 0.037 |

| Nov 2024 | 0.396 | 0.383 | 0.171 | 0.023 | 0.025 |

| Dec 2024 | 0.444 | 0.326 | 0.178 | 0.024 | 0.026 |

| Jan 2025 | 0.443 | 0.349 | 0.157 | 0.026 | 0.022 |

| Feb 2025 | 0.410 | 0.323 | 0.215 | 0.024 | 0.025 |

| Mar 2025 | 0.380 | 0.366 | 0.200 | 0.022 | 0.029 |

| Apr 2025 | 0.392 | 0.377 | 0.170 | 0.028 | 0.030 |

| May 2025 | 0.365 | 0.375 | 0.205 | 0.028 | 0.024 |

CRM Competitors

| Aug 2023 | 0.423 | 0.194 | 0.104 | 0.103 | 0.084 | 0.056 | 0.031 |

|---|---|---|---|---|---|---|---|

| Sep 2023 | 0.441 | 0.202 | 0.089 | 0.108 | 0.072 | 0.059 | 0.026 |

| Oct 2023 | 0.423 | 0.194 | 0.105 | 0.103 | 0.084 | 0.056 | 0.031 |

| Nov 2023 | 0.396 | 0.223 | 0.098 | 0.119 | 0.079 | 0.053 | 0.028 |

| Dec 2023 | 0.382 | 0.216 | 0.095 | 0.114 | 0.093 | 0.062 | 0.033 |

| Jan 2024 | 0.392 | 0.220 | 0.097 | 0.117 | 0.078 | 0.064 | 0.028 |

| Feb 2024 | 0.365 | 0.207 | 0.110 | 0.133 | 0.089 | 0.060 | 0.032 |

| Mar 2024 | 0.365 | 0.207 | 0.110 | 0.133 | 0.089 | 0.060 | 0.032 |

| Apr 2024 | 0.395 | 0.222 | 0.098 | 0.118 | 0.079 | 0.053 | 0.031 |

| May 2024 | 0.413 | 0.191 | 0.102 | 0.123 | 0.082 | 0.055 | 0.030 |

| Jun 2024 | 0.390 | 0.229 | 0.097 | 0.117 | 0.078 | 0.052 | 0.034 |

| Jul 2024 | 0.419 | 0.208 | 0.085 | 0.125 | 0.084 | 0.046 | 0.030 |

| Aug 2024 | 0.417 | 0.196 | 0.103 | 0.124 | 0.083 | 0.045 | 0.028 |

| Sep 2024 | 0.353 | 0.268 | 0.107 | 0.106 | 0.086 | 0.047 | 0.029 |

| Oct 2024 | 0.347 | 0.246 | 0.105 | 0.126 | 0.085 | 0.057 | 0.031 |

| Nov 2024 | 0.396 | 0.224 | 0.099 | 0.118 | 0.079 | 0.053 | 0.028 |

| Dec 2024 | 0.379 | 0.216 | 0.116 | 0.113 | 0.092 | 0.051 | 0.030 |

| Jan 2025 | 0.395 | 0.225 | 0.098 | 0.118 | 0.079 | 0.053 | 0.029 |

| Feb 2025 | 0.359 | 0.252 | 0.110 | 0.107 | 0.088 | 0.048 | 0.032 |

| Mar 2025 | 0.337 | 0.246 | 0.103 | 0.123 | 0.101 | 0.055 | 0.033 |

| Apr 2025 | 0.348 | 0.244 | 0.105 | 0.127 | 0.085 | 0.057 | 0.031 |

| May 2025 | 0.368 | 0.217 | 0.111 | 0.134 | 0.090 | 0.049 | 0.027 |

| Aug 2023 | 307 |

|---|---|

| Sep 2023 | 477 |

| Oct 2023 | 425 |

| Nov 2023 | 442 |

| Jan 2024 | 461 |

| Feb 2024 | 364 |

| Mar 2024 | 492 |

| Apr 2024 | 499 |

| May 2024 | 363 |

ServiceNow Social Media Accounts

| May 2025 | 49753 |

|---|---|

| Jul 2025 | 53390 |

| Aug 2025 | 54689 |

CRM

| 26 Feb 2023 | 73 |

|---|---|

| 5 Mar 2023 | 93 |

| 12 Mar 2023 | 82 |

| 19 Mar 2023 | 76 |

| 26 Mar 2023 | 78 |

| 2 Apr 2023 | 78 |

| 9 Apr 2023 | 82 |

| 16 Apr 2023 | 79 |

| 23 Apr 2023 | 68 |

| 30 Apr 2023 | 70 |

| 7 May 2023 | 67 |

| 14 May 2023 | 61 |

| 21 May 2023 | 67 |

| 28 May 2023 | 72 |

| 4 Jun 2023 | 71 |

| 11 Jun 2023 | 76 |

| 18 Jun 2023 | 73 |

| 25 Jun 2023 | 69 |

| 2 Jul 2023 | 53 |

| 9 Jul 2023 | 47 |

ITSM

| 26 Feb 2023 | 65 |

|---|---|

| 5 Mar 2023 | 69 |

| 12 Mar 2023 | 72 |

| 19 Mar 2023 | 72 |

| 26 Mar 2023 | 77 |

| 2 Apr 2023 | 72 |

| 9 Apr 2023 | 77 |

| 16 Apr 2023 | 74 |

| 23 Apr 2023 | 65 |

| 30 Apr 2023 | 61 |

| 7 May 2023 | 68 |

| 14 May 2023 | 58 |

| 21 May 2023 | 64 |

| 28 May 2023 | 62 |

| 4 Jun 2023 | 61 |

| 11 Jun 2023 | 62 |

| 18 Jun 2023 | 62 |

| 25 Jun 2023 | 64 |

| 2 Jul 2023 | 43 |

| 9 Jul 2023 | 34 |

Numbers represent search interest relative to the highest point on the chart for the given region and time.

A value of 100 is the peak popularity for the term.

A value of 50 means that the term is half as popular.

A score of 0 means there was not enough data for this term.

| Sep 2023 | 727 |

|---|---|

| Oct 2023 | 650 |

| Nov 2023 | 655 |

| Dec 2023 | 545 |

| Jan 2024 | 815 |

| Feb 2024 | 1,076 |

| Apr 2024 | 1,155 |

| May 2024 | 1,054 |

| Jun 2024 | 906 |

| Jul 2024 | 724 |

| Dec 2024 | 684 |

| Sep 2023 | 20,433 |

|---|---|

| Oct 2023 | 20,433 |

| Nov 2023 | 20,433 |

| Dec 2023 | 20,433 |

| Jan 2024 | 20,433 |

| Feb 2024 | 22,668 |

| Mar 2024 | 22,668 |

| Apr 2024 | 22,668 |

| May 2024 | 22,668 |

| Jun 2024 | 22,668 |

| Jul 2024 | 22,668 |

ServiceNow other data

| Period | Buy | Sel |

|---|---|---|

| Jan 2024 | 0 | 2632 |

| Feb 2024 | 0 | 50669 |

| May 2024 | 0 | 450 |

| Nov 2024 | 0 | 35010 |

| Transaction | Date | Insider | Security | Shares | Price per share | Total value | Source |

|---|---|---|---|---|---|---|---|

Sale | CHAMBERLAIN PAUL EDWARD director | Common Stock | 300 | $1,047.95 | $314,385 | ||

Sale | TZITZON NICHOLAS officer: Chief Strat & Corp Aff.. | Common Stock | 313 | $1,064.6 | $333,220 | ||

Sale | SANDS ANITA M director | Common Stock | 2,229 | $1,064.6 | $2,372,993 | ||

Sale | MCDERMOTT WILLIAM R director, officer.. | Common Stock | 12,296 | $997.67 | $12,267,350 | ||

Sale | MCDERMOTT WILLIAM R director, officer.. | Common Stock | 12,296 | $997.67 | $12,267,350 | ||

Sale | MCDERMOTT WILLIAM R director, officer.. | Common Stock | 12,271 | $997.67 | $12,242,409 | ||

Sale | MCDERMOTT WILLIAM R director, officer.. | Common Stock | 12,271 | $997.67 | $12,242,409 | ||

Sale | SMITH PAUL JOHN officer: Chief Commercial Officer | Common Stock | 89 | $997.67 | $88,793 | ||

Sale | ELMER RUSSELL S officer: General .. | Common Stock | 81 | $1,016.54 | $82,340 | ||

Sale | ELMER RUSSELL S officer: General .. | Common Stock | 81 | $1,016.54 | $82,340 |

| Patent |

|---|

Grant Filling date: 13 Jul 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 6 Jul 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 16 Jun 2020 Issue date: 20 Sep 2022 |

Grant Filling date: 25 Oct 2019 Issue date: 20 Sep 2022 |

Grant Filling date: 6 Dec 2018 Issue date: 20 Sep 2022 |

Grant Filling date: 21 Oct 2020 Issue date: 13 Sep 2022 |

Grant Filling date: 10 Aug 2020 Issue date: 13 Sep 2022 |

Grant Filling date: 6 Jul 2020 Issue date: 13 Sep 2022 |

Grant Utility: Modified representational state transfer (REST) application programming interface (API) including a customized GraphQL framework Filling date: 9 Jan 2020 Issue date: 13 Sep 2022 |

Grant Filling date: 29 Mar 2019 Issue date: 13 Sep 2022 |

| Quarter | Transcript |

|---|---|

| Q1 2024 24 Apr 2024 | Q1 2024 Earnings Call Transcript |

| Q4 2023 24 Jan 2024 | Q4 2023 Earnings Call Transcript |

| Q3 2023 25 Oct 2023 | Q3 2023 Earnings Call Transcript |

| Q2 2023 26 Jul 2023 | Q2 2023 Earnings Call Transcript |

| Insider | Compensation |

|---|---|

| Mr. William R. McDermott (1962) Pres, Chief Executive Officer & Director | $6,720,000 |

| Ms. Gina M. Mastantuono (1970) Chief Financial Officer | $1,630,000 |

| Mr. Chirantan Jitendra Desai (1971) Chief Product & Engineering Officer | $1,370,000 |

| Mr. Kevin Haverty (1966) Chief Revenue Officer | $1,150,000 |

| Mr. Russell S. Elmer (1965) Gen. Counsel & Sec. | $899,230 |

From Nvidia's Surge To Apple's Slip: 6 Stocks That Defined Ithaka's Quarter

ClearBridge Large Cap Growth Strategy Q2 2025 Portfolio Positioning

These Are The Most Overvalued And Undervalued Mega Cap Stocks

ServiceNow: Growth Runway Is Still Long And Bright

What Makes ServiceNow A Rare Tech Compounder In A Noisy Market

NICE: Revenue Growth Should Accelerate

Rimini Street: Litigation Risks Are Out, A Cautious Buy

ServiceNow: Nothing Stops The AI Train

Radcom: Category Leader Growing At 18% At An 8.8x Cash P/E

-

What's the price of ServiceNow stock today?

One share of ServiceNow stock can currently be purchased for approximately $883.1.

-

When is ServiceNow's next earnings date?

ServiceNow, Inc. is estimated to report earnings on Tuesday, 21 Oct 2025.

-

Does ServiceNow pay dividends?

No, ServiceNow does not pay dividends.

-

How much money does ServiceNow make?

ServiceNow has a market capitalization of 222.03B and it's past years’ income statements indicate that its last revenue has increased compared to the previous period by 23.82% to 8.97B US dollars. ServiceNow earned 1.73B US dollars in net income (profit) last year or $3.72 on an earnings per share basis.

-

What is ServiceNow's stock symbol?

ServiceNow, Inc. is traded on the NYSE under the ticker symbol "NOW".

-

What is ServiceNow's primary industry?

Company operates in the Technology sector and Software - Application industry.

-

How do i buy shares of ServiceNow?

Shares of ServiceNow can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

-

Who are ServiceNow's key executives?

ServiceNow's management team includes the following people:

- Mr. William R. McDermott Pres, Chief Executive Officer & Director(age: 63, pay: $6,720,000)

- Ms. Gina M. Mastantuono Chief Financial Officer(age: 55, pay: $1,630,000)

- Mr. Chirantan Jitendra Desai Chief Product & Engineering Officer(age: 54, pay: $1,370,000)

- Mr. Kevin Haverty Chief Revenue Officer(age: 59, pay: $1,150,000)

- Mr. Russell S. Elmer Gen. Counsel & Sec.(age: 60, pay: $899,230)

-

How many employees does ServiceNow have?

As Jul 2024, ServiceNow employs 22,668 workers.

-

When ServiceNow went public?

ServiceNow, Inc. is publicly traded company for more then 13 years since IPO on 29 Jun 2012.

-

What is ServiceNow's official website?

The official website for ServiceNow is servicenow.com.

-

Where are ServiceNow's headquarters?

ServiceNow is headquartered at 2225 Lawson Lane, Santa Clara, CA.

-

How can i contact ServiceNow?

ServiceNow's mailing address is 2225 Lawson Lane, Santa Clara, CA and company can be reached via phone at +40 85018550.

-

What is ServiceNow stock forecast & price target?

Based on 14 Wall Street analysts` predicted price targets for ServiceNow in the last 12 months, the avarage price target is $1,017.27. The average price target represents a 15.19% change from the last price of $883.1.

ServiceNow company profile:

ServiceNow, Inc.

servicenow.comNYSE

22,668

Software - Application

Technology

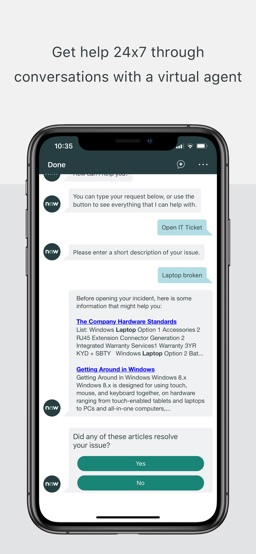

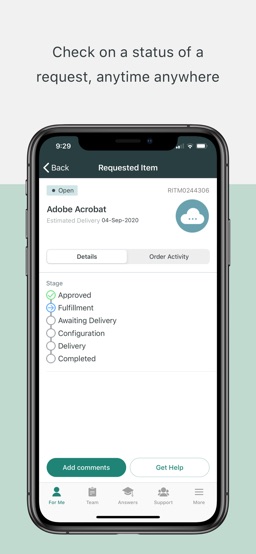

ServiceNow, Inc. provides enterprise cloud computing solutions that defines, structures, consolidates, manages, and automates services for enterprises worldwide. It operates the Now platform for workflow automation, artificial intelligence, machine learning, robotic process automation, performance analytics, electronic service catalogs and portals, configuration management systems, data benchmarking, encryption, and collaboration and development tools. The company also provides information technology (IT) service management applications; IT service management product suite for enterprise's employees, customers, and partners; IT business management product suite; IT operations management product that connects a customer's physical and cloud-based IT infrastructure; IT Asset Management to automate IT asset lifecycles; and security operations that connects with internal and third party. In addition, it offers governance, risk, and compliance product to manage risk and resilience; human resources, legal, and workplace service delivery products; safe workplace applications; customer service management product; and field service management applications. Further, it provides App Engine product; IntegrationHub enables application to extend workflows; and professional, industry solutions, and customer support services. It serves government, financial services, healthcare, telecommunications, manufacturing, IT services, technology, oil and gas, education, and consumer products through direct sales team and resale partners. It has a strategic partnership with Celonis to help customers identify and prioritize processes that are suitable for automation. The company was formerly known as Service-now.com and changed its name to ServiceNow, Inc. in May 2012. The company was founded in 2004 and is headquartered in Santa Clara, California.

Santa Clara, CA 95054

CIK: 0001373715

ISIN: US81762P1021

CUSIP: 81762P102